All big financial institutions have to deal with lawsuits from time to time — some with merit, some less so. But when suits alleging the same pattern of improper conduct and poor client treatment start piling up, it’s time to start asking questions about the bigger picture of corporate culture.

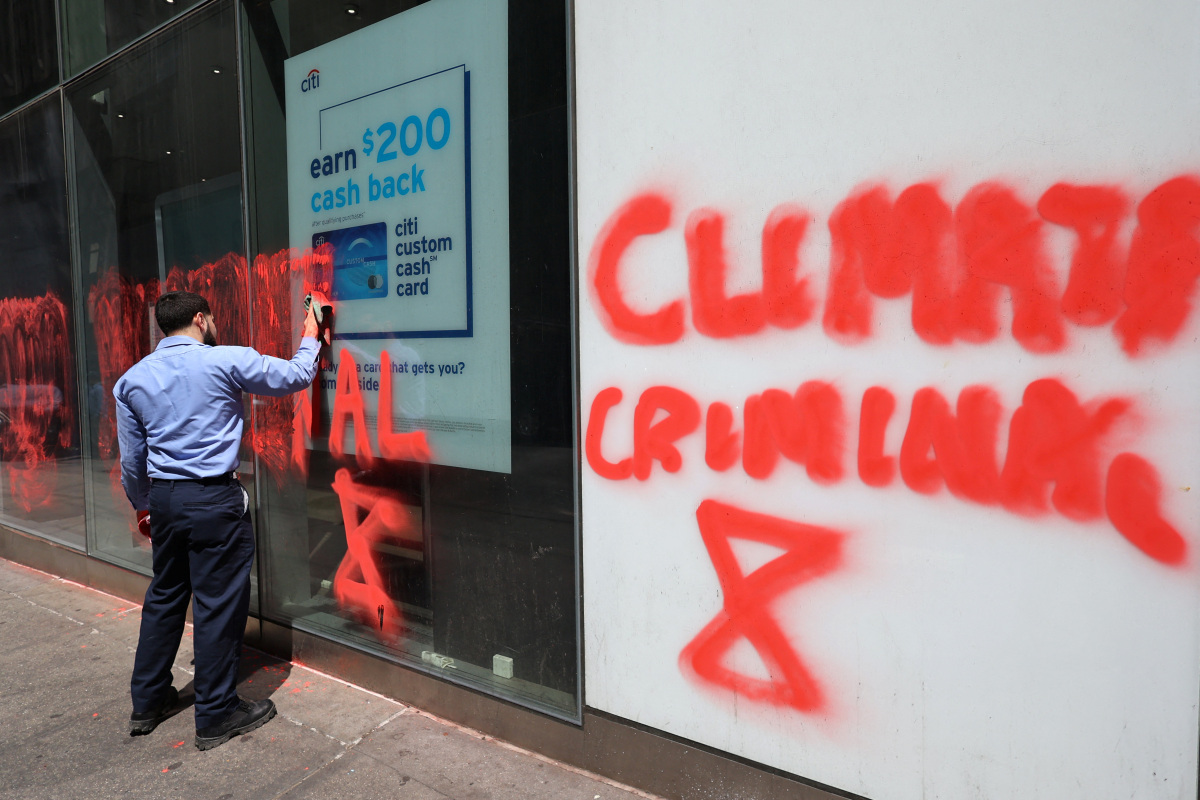

Citigroup, for example, has been hit with a torrent of suits and scandals in recent years — all centered on the abusive way the bank has treated its customers.

And while the market capitalizations of big banks have mostly rebounded since the financial crisis of 2008, Citigroup’s is still limping along. The company has lost almost 90% of its market value over the past two decades.

Citigroup management needs to remember how the company became America’s fourth-largest bank in the first place. The bank seems to have lost its erstwhile commitment to customer service and protection in a sea of toxicity.

The details of several recent lawsuits illustrate how much work the bank has to do to rebuild customer confidence and its reputation as a trusted advisor.

Take the case of Scott Jacobson of Skokie, Illinois. In October 2021, Jacobson discovered that scammers in Thailand had stolen $121,000 from his disabled sister’s Citibank account. When Jacobson reported the theft, Citibank simply told him to get a lawyer. No help from the bank. Not even an investigation to make sure the hackers didn’t hit any other customers. Jacobson sued and won. An arbitrator found that Citi violated its funds-transfer agreement, ignored its own scam alert system, and failed to get Scott’s approval for obviously fishy international wire transfers.

Then there’s the case of Robert and Laurene Yurkovich of Calgary, Canada. In 2018, the Yurkoviches, a retired couple, had a margin loan with Citibank, pledging as collateral millions of their shares in a leading public Canadian natural gas company.

But then COVID-19 struck. In the face of an unprecedented global market collapse, the Yurkoviches agreed on a solution with Citibank — to ensure that their margin loan and pledged shares would not be impacted by the market downturn. Despite this, on March 19, 2020, Citibank abruptly changed course, demanded immediate repayment of the loan, and ultimately sold almost 3 million of the Yurkoviches’ shares — seizing $6 million of the couple’s cash to pay itself back. Citibank did this even though the loan was not at risk of going unpaid — and despite the previously agreed upon solution to avoid a sell off.

It seems Citibank just exploited them during a fluke drop in oil prices that everyone at the time knew was only temporary. To no one’s surprise, the oil company’s stock price almost doubled between mid-March and late-April 2020, and has increased almost eight-fold since. Citibank appears to have arbitrarily squandered tens of millions of dollars of its customers’ money — for no reason.

Or consider the story of 80-year-old Louis Markatos of Briarcliff Manor, N.Y., whose Citibank account was emptied of $1.5 million in 2023 by scammers posing as Apple tech support. According to Markatos’s lawsuit, Citi’s oversight personnel once again saw and simply ignored highly suspicious activity in a vulnerable depositor’s account.

In New York just this year, Citi victimized a customer who did everything right. Targeted by scammers, she did not provide them with any account information. She immediately reported the incident. Citi told her not to worry. When $40,000 disappeared from her account three days later, Citi denied her fraud claim. This is not customer service, but rather neglect.

This was one of several incidents that led New York Attorney General Letitia James to sue Citi for its systemic, dishonest, and sometimes, criminal customer abuse. Piled on top of repeated and hefty fines imposed by regulators on multiple continents, it seems that Citi’s abuses and client negligence aren’t just a series of discrete stories but are all part of the same story.

It’s long past time for Citi to change its culture. The abusive tactics getting Citi sued and fined represent learned behavior that a sincere corporate recommitment to customer service and protection could easily correct. Some of the work will involve formal retraining, incentive restructuring, and updating lax systems. But honest, good-faith customer service is hardly a novel corporate strategy. In fact, on Wall Street, for high-net-worth individuals, and for all banking customers, it should be the norm.

For all its problems, Citigroup is still an enormous, powerful corporation with more than 200 million customer accounts. Management can change course by using the bank’s power and resources as shields to protect their customers instead of swords to threaten them. The future of Citigroup depends on doing just that.

Stacy Washington is the host of “Stacy on the Right,” which airs nightly from 9 pm to midnight ET on SiriusXM Patriot Channel 125. She is a decorated Air Force veteran, an Emmy-nominated TV personality, and the author of “Eternally Cancel Proof — A Guide for Courageous Christians Navigating the Political Battlefront.”