[ad_1]

Reuters

Tumult in the banking system has roiled investors over the past week, sending Treasury yields into a tailspin, slamming U.S. bank stocks and exacerbating fears of global financial contagion.

More shockwaves may be ahead. Though regulators in the U.S. and Europe have closed Silicon Valley Bank and Signature Bank and offered a liquidity lifeline to embattled Credit Suisse, investors fear the Federal Reserve’s most aggressive monetary policy tightening in decades will continue to widen cracks in the financial system and expose vulnerable companies.

“Many metrics of core market functioning have worsened worryingly fast, but the overall situation is still long way short of the type of strains seen during the worst parts of the Global Financial Crisis or the early stages of the COVID-19 pandemic,” Capital Economics analysts including Jonas Goltermann, the deputy chief markets economist, wrote in a report on Thursday.

Uncertainty over the U.S. central bank’s monetary policy path is adding to investor worries, as bets rapidly shift on whether it will continue raising rates or announce a pause at its March 21-22 meeting.

Here is a look at some of the most important market fallout of the last few days:

Banking worries unleashed historic volatility in the Treasury market, as traders reversed their bets on higher rates amid growing expectations the Fed would pause or slow its rate increases to avoid exacerbating stress in the financial system.

Yields on two-year Treasuries, which closely follow Fed policy expectations, marked their biggest one-day drop in decades on Monday, while the benchmark 10-year yield has declined some 40 basis points in a week.

The ICE BofA MOVE Index, a gauge of expected volatility in U.S. Treasuries, remains near its highest level since the global financial crisis.

(GRAPHIC: Treasury market volatility –

)

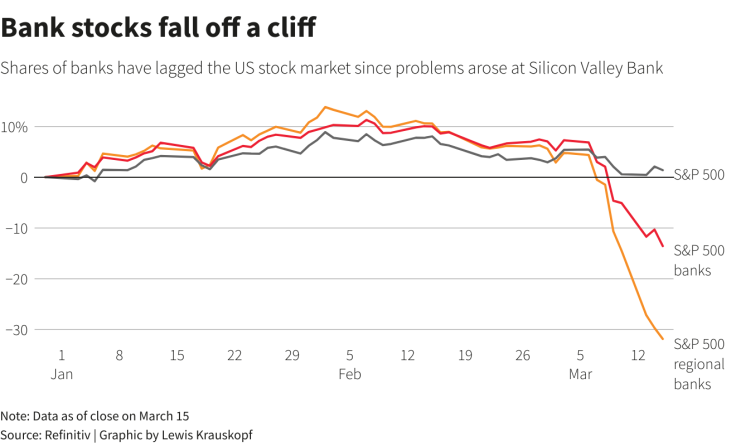

Shares of U.S. banks have been hammered following the collapse of Silicon Valley Bank, the biggest bank failure since the financial crisis, and Signature Bank, with regional bank shares especially punished. The S&P 500 banks index was rebounding modestly on Thursday, after sinking 15% in a week.

(GRAPHIC: Bank stocks fall off a cliff –

)

Worries about credit stress appear to be rising. The Markit CDX North American Investment Grade Index, a basket of credit default swaps that serves as a gauge of credit risk, widened to its biggest gap since late last year, as investors hedged bets on a deterioration in credit quality.

The CDS index is still far below where it stood in 2020, when markets were gripped by the coronavirus pandemic, and the levels it reached during the financial crisis 15 years ago.

(GRAPHIC: Rising credit stress –

)

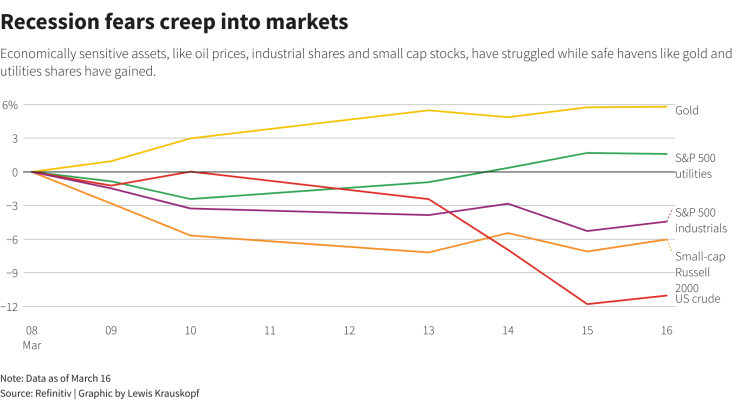

Markets are also reflecting concern that stress in the banking system may be bringing a recession closer. Economically sensitive assets such as oil and small-cap stocks, have headed lower since Silicon Valley Bank’s problems made headlines on March 8. Gold, seen as a safe haven in rocky times, has climbed more than 5% during that period.

(GRAPHIC: Pricing in recession fears –

)

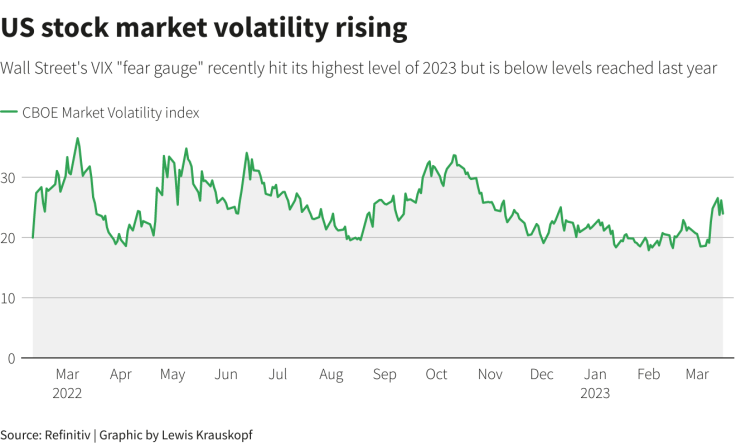

Stock markets have also become more volatile. The CBOE Market Volatility Index recently hit its highest level since October. The index, known as Wall Street’s “fear gauge,” remains below levels reached in 2022. But the benchmark S&P 500 index was last down just over 1% since the Silicon Valley troubles arose, and is logging a modest gain for 2023.

(GRAPHIC: US stock market volatility rising –

)

[ad_2]

Source link