Rising living costs, prolonged inflation, job uncertainty, and financial mistakes in early working years are making it challenging for Americans to retire. Even those who have saved diligently for decades are fearful of hanging up their boots. Many of them think that their savings will not last through retirement.

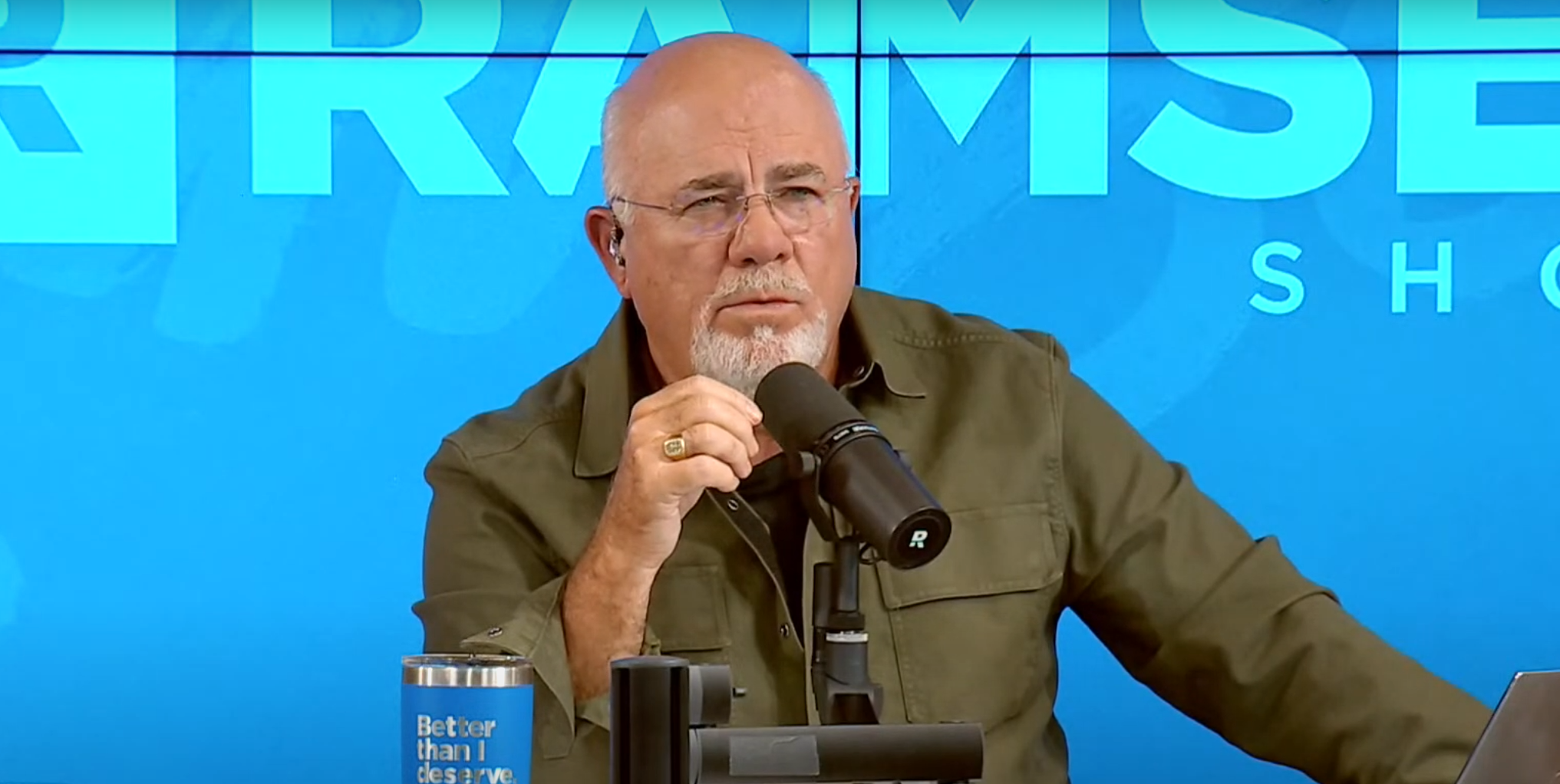

A 62-year-old called the Dave Ramsey show and shared that despite having savings of $3.5 million across 401(k)s and individual retirement accounts (IRAs), he is hesitant to retire. Worried about health insurance coverage and giving up his annual income of $175,000, the caller said: ‘I’m having a hard time getting comfortable with that.’

The caller confirmed that he started with nothing and ended up a multi-millionaire. ‘I am very proud of you. The American Dream is not dead,’ Ramsey told the caller.

Ramsey’s Straightforward Retirement Income Strategy

In an attempt to alleviate the caller’s fears, Ramsey said that $3.5 million invested in good growth stocks and mutual funds can fetch $350,000 a year, assuming annual returns of 10%. ‘Income that it produces without touching the nest egg. Twice what you make now,’ Ramsey said.

The caller responded by saying that he is worried about the unpredictable stock market cycle and has no clue how to navigate years when markets are down. Ramsey simply suggested that he used some of the savings during market upheavals.

The caller’s dilemma is a widespread concern among millions of Americans nearing retirement age. At 62, seniors can claim Social Security income, and many are applying for it as soon as they become eligible, getting locked into lower monthly cheques for life. Social Security income could be as low as 30% for those applying at age 62 compared with people claiming at 70.

However, the caller’s retirement nest egg of $3.5 million is well above the national average. According to Empower, the average 401(k) balance for people in their 60s was $577,454 as of November 2025, which is lower than the $635,320 for those in their 50s. This gap could be because people are retiring in their early 60s and already taking distributions from their 401(k)s.

Cost of Living Varies Across the US

Americans worrying about how to cover the costs of living in retirement can explore relocation as an option to manage household expenses without burning through decades of savings.

According to a recent GOBankingRates study, the annual cost of a comfortable retirement can differ wildly depending on the US state you live in. For instance, it costs retirees an average of $129,296 annually to live comfortably in Hawaii, which drops to $61,315 if you settle in Mississippi.

Housing remains the biggest differentiator in the cost of living in each US state. In Hawaii, high demand and limited space for homes drive up living costs, while in Mississippi, home prices and property taxes are among the lowest in the US, which helps to keep retirement costs down.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.

Originally published on IBTimes UK