India’s electronics system design and manufacturing (ESDM) industry is on a trajectory of rapid growth, with projections indicating a surge from Rs 2.09 lakh crore in FY23 to a staggering Rs 9.09 lakh crore by FY28E. This represents a compound annual growth rate (CAGR) of 34 per cent, according to a recent report by PL Capital Group – Prabhudas Lilladher. The ESDM sector, which forms the backbone of the digital economy, is witnessing a paradigm shift. The industry’s addressable market, valued at Rs 4.39 lakh crore in FY23, is seeing a gradual increase in reliance on ESDM partners by original equipment manufacturers (OEMs).

The growth of the ESDM industry is not an isolated phenomenon. It is a reflection of the larger trend of increasing demand for electronics, both domestically and globally. India’s large and expanding domestic market is a fertile ground for the growth of the ESDM industry. The ‘China +1′ strategy, which encourages businesses to consider countries other than China for their manufacturing needs, is also contributing to the industry’s growth. Government initiatives are playing a crucial role in propelling the industry forward. The production-linked incentive (PLI) scheme and investments in semiconductor development are significant government initiatives that are fuelling the growth of the ESDM industry.

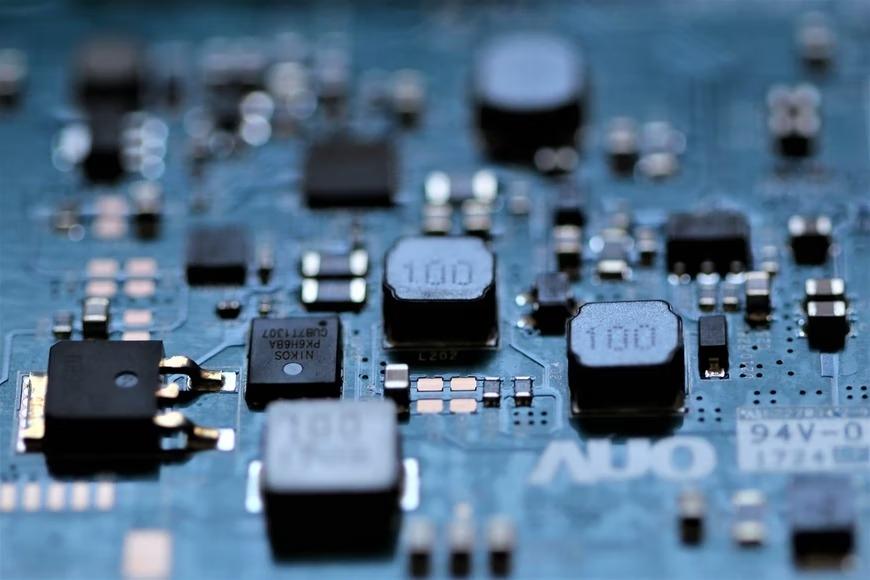

The domestic printed circuit board assembly (PCBA) market is another segment that is expected to witness significant growth. The market, valued at Rs 2.31 lakh crore in FY23, is projected to reach Rs 6.55 lakh crore by FY26E, clocking a CAGR of 41.6 per cent. The growth of the PCBA market is driven by factors such as increasing value addition, rising global demand for electronics, and the need for high-speed assembly and miniaturisation. India is capitalising on this growth opportunity by incentivising contract manufacturers and expanding its manufacturing capabilities. This strategy is expected to boost PCBA exports, further enhancing India’s role in the global supply chain and strengthening its position as an electronics manufacturing hub.

The report by PL Capital Group – Prabhudas Lilladher has initiated coverage on four domestic ESDM companies – Avalon Technologies, Cyient, Kaynes Technology and Syrma SGS Technology. These companies are well-positioned for growth, supported by diverse sector penetration, strong order books, and strategic expansion plans. The growth of the ESDM industry is a win-win situation for both OEMs and ESDM firms. As OEMs delegate manufacturing to ESDM partners, they can concentrate on marketing and post-sales services and growth initiatives. On the other hand, ESDM firms can leverage economies of scale to adapt to technological changes and negotiate better with suppliers.

The Indian ESDM industry is poised for exponential growth, driven by a confluence of factors such as increasing demand for electronics, government initiatives, and a shift in manufacturing strategies. The industry’s growth will not only boost India’s economy but also enhance its role in the global supply chain. The future of the ESDM industry looks promising, with opportunities for growth and innovation abound.