[SINGAPORE] Asset manager Keppel saw net profit rise 24.2 per cent on the year to S$377.7 million for the first half ended Jun 30, driven by growth in its real estate segment.

This translates to an earnings per share of S$0.208, up 23.1 per cent from S$0.169 a year earlier.

The profit growth came even as Keppel’s top line fell 5.2 per cent to S$3.1 billion. Revenue from the infrastructure segment was down by 12 per cent at S$2 billion, with lower net generation in the integrated power business. The segment’s net profit fell 4.9 per cent to S$346.6 million.

Performance was lifted by the real estate segment, which posted a S$97.6 million net profit, reversing the year-ago S$19.6 million net loss. Revenue was up 45 per cent at S$94.8 million – on the back of contributions from an India office project acquired last year, as well as a senior living operator in the United States that was consolidated in March

Revenue also rose in the connectivity segment – which includes data centres and telco M1 – by 13.9 per cent to S$742.4 million.

Keppel’s data centre business benefited from higher facility management revenue, while M1 recorded higher enterprise revenue, with contributions from the newly acquired ADG in Vietnam. It also enjoyed higher handset and equipment sales, even as mobile revenue fell.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

However, the segment’s net profit fell 16.9 per cent to S$57.5 million, with lower overall earnings from M1, and lower valuation gains on sponsor stakes in private funds.

Keppel announced an interim dividend of S$0.15 per share – unchanged from the year-ago period, as well as a S$500 million share buyback programme.

The repurchased shares will be used in part for the annual vesting of employee share plans, and as possible currency for future merger and acquisition activities.

S$14.4 billion divestment portfolio

Separately, Keppel has identified a portfolio of non-core assets with a carrying value of S$14.4 billion to be “substantially monetised” by 2030.

The divestment portfolio comprises legacy offshore and marine assets, residential landbank, selected property developments and investment properties, and S$2.9 billion of embedded cash and receivables.

It also includes hospitality and logistics assets and other non-core investments.

The portfolio recorded a net loss of S$53.3 million in H1, deeper than the year ago S$40.5 million loss. Excluding the impact of this portfolio, Keppel’s net profit would have risen 25 per cent to S$431 million.

There is significant value to be unlocked from releasing the part of the balance sheet that is not required by the “New Keppel”, said the company’s chief executive Loh Chin Hua.

“As we accelerate the growth of ‘New Keppel’, we expect that the market will re-rate our stock price and accord us a growth multiple,” he said at an earnings briefing on Thursday (Jul 31). “In addition, the net asset value of the non-core portfolio, which we will monetise over time, should also carry further value.”

Keppel has divested S$915 million of assets in the year to date, raising the cumulative total to S$7.8 billion since such efforts began in October 2020.

Loh noted that the non-core assets are no longer aligned with Keppel’s asset-light, recurring income-focused strategy, even though many are profitable. The assets include residential landbanks carried at historical costs.

“Monetising the substantial non-core portfolio, whose carrying value is larger than our gross debt, will give us ample opportunity over time to reduce debt, fund growth for the ‘New Keppel’ and return capital to shareholders,” said Loh.

With the asset-light strategy, return on equity is expected to be “significantly above” 15 per cent, he added.

Asked which peers “New Keppel” could be compared to, Loh cited global asset management firms Brookfield, KKR, BlackRock and Blackstone – albeit noting that Keppel is unique in having both asset management and operations.

M1 under pressure

Asked about plans for M1, Loh said that Keppel is open to divestment, but looking more at potential monetisation of the consumer mobile side of the business.

The market is under “severe competitive pressure” with four operators and about seven mobile virtual network operators, noted Manjot Singh Mann, chief executive of Keppel’s connectivity segment.

“It’s an overcrowded market, and we are seeing a lot of SIM-only plans replacing contract plans, and that is why there is a bit of an ARPU dilution as well,” he said, referring to average revenue per user.

That said, M1 is still “fighting hard” on the consumer business, while also growing on the enterprise front, said Mann.

He sees cloud solutions having a “huge amount of synergy” with Keppel’s data centres.

Asean power grid, green projects

Growth is also expected in the infrastructure business in the next few years, with one gigawatt of new power capacity coming onstream. This is from the 600 megawatt (MW) Keppel Sakra Cogen Plant in H1 2026 and another potential 300 to 500 MW of renewable energy imports from 2028.

Opportunities in the development of the Asean power grid are “very promising” and Keppel is a “frontrunner”, said Cindy Lim, chief executive of the infrastructure business.

“There’s a lot of synergy for us to bring low-carbon and renewable power to capture the connectivity space, specifically the high demand for AI data centres,” she added.

Separately, the real estate division will focus on sustainable urban renewal solutions across five projects with a combined asset value of S$1.8 billion, to focus on both sustainability and investment returns.

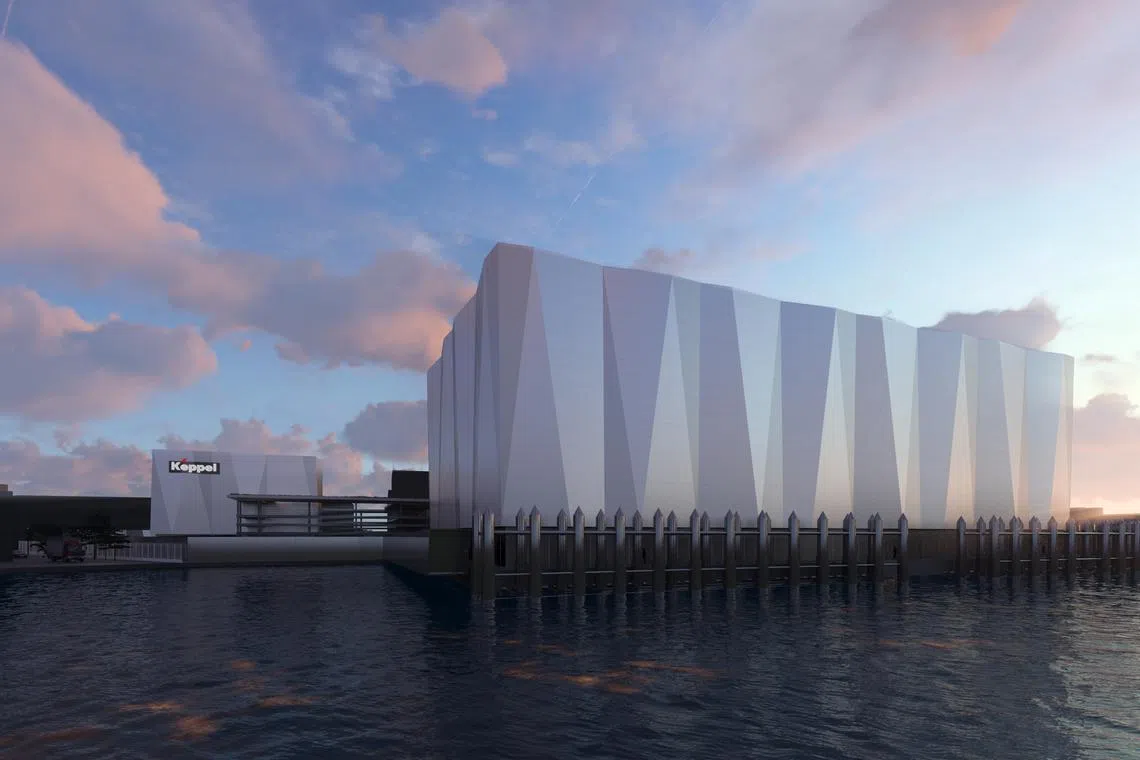

In the data sector division, Keppel is awaiting final approval from the authorities for its 25 MW floating data centre in Singapore, with construction expected to start in Q4 and finish by end-2028.

The Bifrost Cable System – which is set to connect South-east Asia to North America – has completed marine cable laying operations and is expected to be ready for service by end-September.

Looking ahead, Keppel is in the process of negotiating over S$500 million worth of real estate and connectivity asset monetisation transactions, which it hopes to finalise before the year-end, said Loh.

Keppel’s funds under management (FUM) stood at S$91 billion as at end-June, while asset management fees amounted to S$195 million. The company is confident of achieving its S$100 billion FUM target by end-2026.

Its private funds – such as those for data centres, education assets and sustainable urban renewal – have raised a combined FUM of S$4.7 billion year to date.

Keppel shares traded at S$8.61 as at 12.35 pm on Thursday, up S$0.43 or 5.3 per cent.