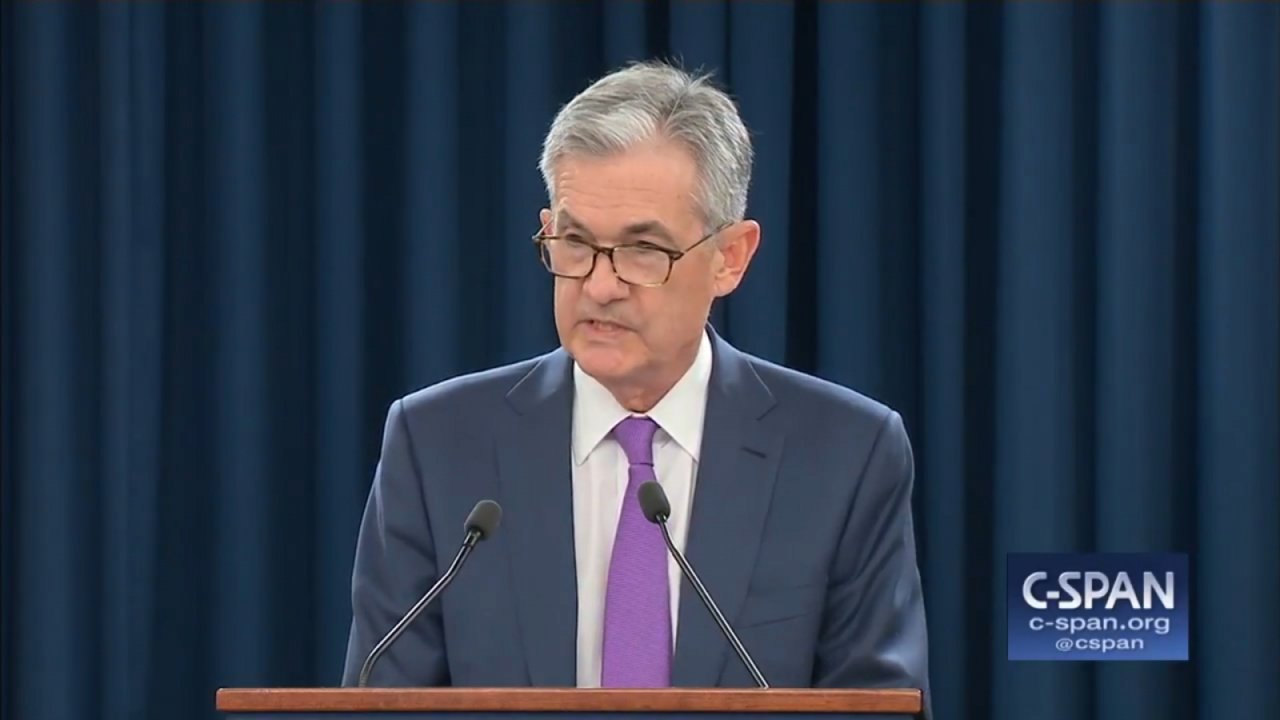

Federal Reserve Chair Jerome Powell said on Friday the US central bank will go ahead with interest rate hikes in the coming months as the focus at the moment is on taming inflation.

Delivering a stern warning to the markets, households and the economy in general, the Fed chair said there will be “some pain” ahead as the central bank battles to restore price stability.

More Pain

He said raising rates further will slow down economic growth and cause job losses as well. “These are the unfortunate costs of reducing inflation … But a failure to restore price stability would mean far greater pain,” the Fed chair said in his much awaited speech at the annual economic symposium in Jackson Hole, Wyoming.

Powell said his intent is to subdue inflationary pressures and bring back price stability. Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said, the Associated press reported.

He added that the central bank will not shy away from using the tools ‘forcefully’ to tame runaway inflation, which is at a 40-year peak at the moment.

Market Crash

Minutes after the Fed chair made the comments, US stocks edged down. The Nasdaq was down 2.5 percent in morning trade. While the Dow Jones Industrial Average lost 611 points, or 1.85 percent, the S&P 500 fell 2.18 percent.

European stocks were also down in the evening. The pan-European Stoxx was down 1.7 percent after Powell’s comments.

Optimists Proved Wrong

Though some investors had hoped that the Fed chair would drop signs that the central bank was poised to pivot away from the hawkish policy regime, Powell’s speech proved them wrong. Powell clearly stated that the priority of the moment was to bring inflation, which is 9 percent currently, to less than the target level of 2 percent.

YouTube Grab

“We will keep at it until we are confident the job is done … While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down,” Powell said at the central bank conference in Wyoming.

Powell also gave an insight into the Fed’s thought process regarding the September rate setting meeting of the central bank. He said the Fed will consider inflation and jobs data before deciding if the rate hike is one-half or three-quarters of a percentage point.