WALL Street stocks logged a mixed showing on Monday (Jun 3), as investors tried to look past weaker than expected economic data.

The Dow Jones Industrial Average retreated 0.3 per cent to 38,571.03, while the broad-based S&P 500 edged up by 0.1 per cent to 5,283.40.

The tech-focused Nasdaq Composite Index rose by 0.6 per cent to 16,828.67.

The Institute for Supply Management’s (ISM) manufacturing index came in at 48.7 per cent for May – signalling that manufacturing activity contracted for a second straight month.

The figure was also below market expectations.

But investors appeared to have shrugged off the ISM data as the trading day proceeded, noted First National Bank of Omaha chief investment officer Kurt Spieler.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“But it’s another indication, in our opinion, that the economy is slowing,” he said.

Spieler added that the market is still showing some resilience and appears optimistic that there will be a “soft landing” for the world’s biggest economy – meaning a cooldown in inflation without a damaging downturn.

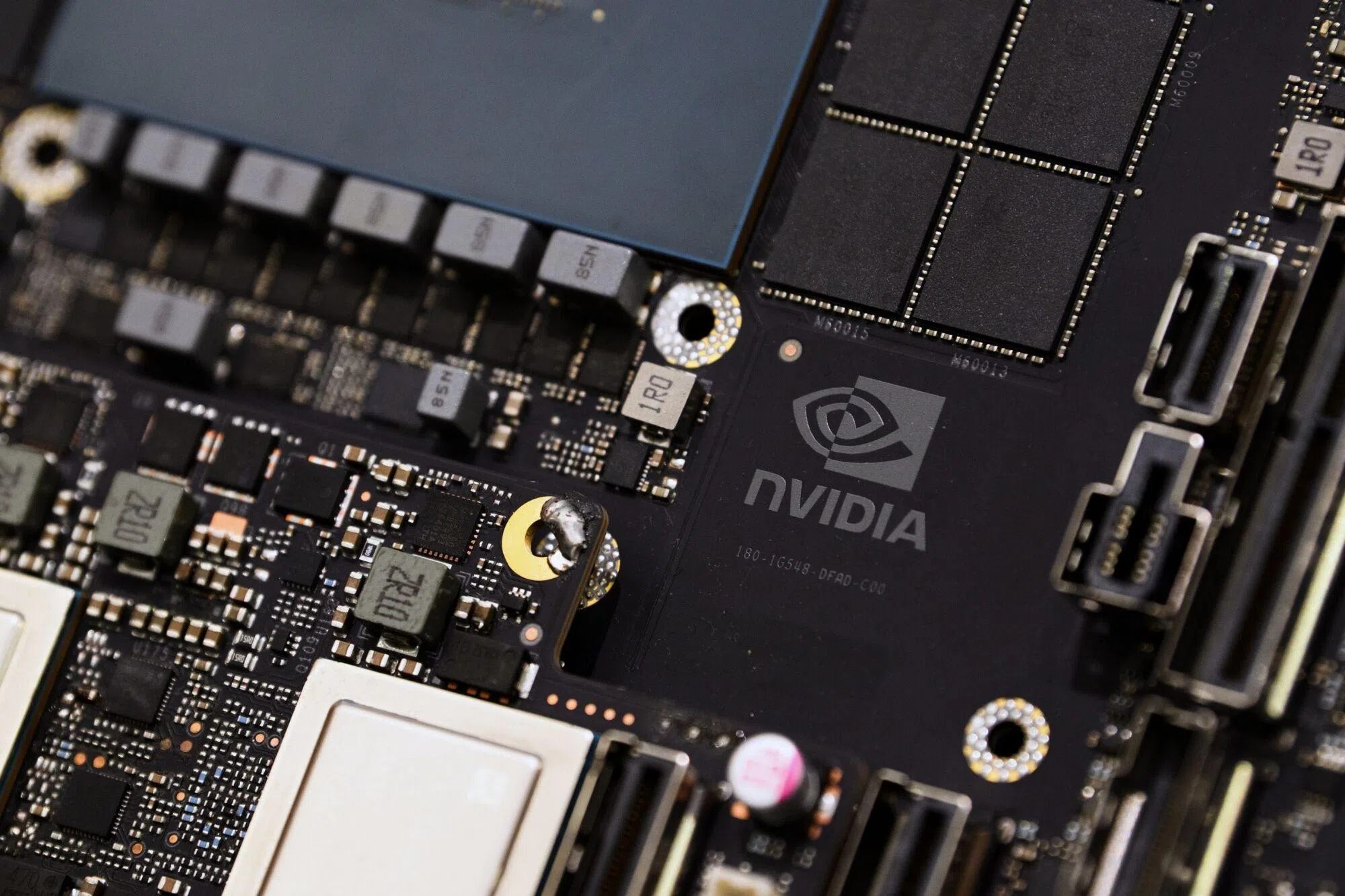

Among individual companies, Nvidia shares advanced 4.9 per cent after the chip giant unveiled new products and plans to speed up the advance of artificial intelligence.

GameStop shares surged 21 per cent after a social media post associated with influential investor Keith Gill.

Later this week, markets are looking ahead to US jobs data and an expected interest rate decision from the European Central Bank. AFP