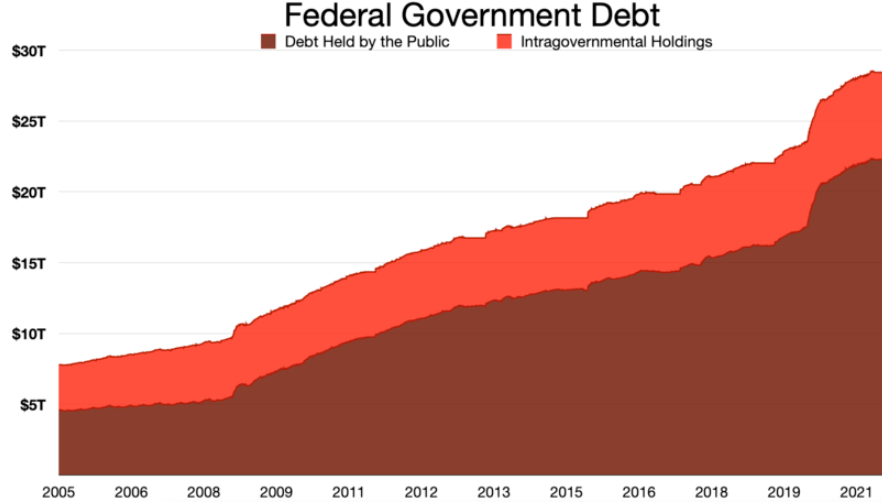

The US national debt has been shooting through the roof in recent years, and the debt levels have reached stratospheric level after big government spending in the last year.

The gross US national debt now stands at $31 trillion, which works out to $93,000 on every American’s head. The gross national debt increases when the government’s spending surpasses the money it brings in through taxes.

Wikimedia Commons / Wikideas1

Right now, as much as $965 million is spent every single day on interest on national debt, according to the Peterson Foundation. The organization predicts that this will triple over the next decade.

The Break-Up

The total national debt is broken up under three heads — intragovernmental debt, public debt and foreign debt. While the intragovernmental debt stands at $6.5 trillion, the debt held by the public is the largest component, at $24 trillion. Around $7.7 trillion is held by foreign governments and private investors.

Several large bills with hefty price tags have been approved since the start of the pandemic, including the American Rescue Plan Act, which cost $1.9 trillion, and $750 billion for student debt relief, all adding to the deficit, which then adds to the debt.

The Recent Spike

The spike in national debt was fueled by large spends like the rescue plan launched during the Covid-19 pandemic and the student loan waiver. While the American Rescue Plan Act cost the treasury $1.9 trillion, $750 billion was spent on student debt relief.

The Outlook

According to the The Committee for a Responsible Federal Budget (CFRB), excessive government borrowing will drive the national debt to a new record as soon as 2030. “Excessive borrowing will lead to continued inflationary pressures, drive the national debt to a new record as soon as 2030, and triple federal interest payments over the next decade â or even sooner if interest rates go up faster or by more than expected,” says the CRFB, according to Yahoo News report. The CRFB estimates that a whopping $4.8 trillion will be added to the US national debt by 2031.

Pixabay

Impact of Interest Rate Hike

A vast chunk of the US national debt was knocked up when the interest rates were at the rock bottom. But with the interest rates rising following successive rate hikes by the Federal Reserve, there will be an exponential rise in the debt load. The federal rates are now in the range of 3 percent and 3.35 percent.

“Since borrowing costs for the U.S. government rises and falls along with interest rates, an increase in the federal funds rate to a predicted 4.6% by the end of 2023 could drastically increase the cost of debt,” says Investopedia.

According to Peter G. Peterson Foundation, the federal rate hikes will result in a $1 trillion rise in the interest payments alone in the coming years.