💬 We need to talk

Money can’t buy love but it can break relationships. Okay, it’s a bit of a pessimistic start to this week’s issue but there’s some truth to the adage.

About half of the couples who see therapist Glenn Woo face differences in their views on money. While it may not always be the main issue they’re facing in their relationship, it does contribute to it, says Woo, who works with counselling provider Talk Your Heart Out.

“Money is something we cannot escape,” she adds. “It permeates everything that we do, so it is important to know your partner’s views, spending habits and concerns or issues they may have surrounding money.”

Usually, conflicts arise when couples can’t agree on how to spend their money, says Woo. They can also occur when one party hides secrets – such as missing payments on credit card or mortgage bills – from their partner out of shame.

The good news is that many of these situations are avoidable, so long as both parties have frequent and open conversations about money.

So, while it may seem like a turnoff to bring up the topic of money on a first date, you shouldn’t wait till you’re about to get married to talk about it either.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“I would say the money conversation should happen as early as possible, once you’re both serious about each other or even in the ‘getting to know you’ stage,” Woo says. “I feel that’s not an inappropriate time to just ask the other person, ‘What are your views on money?’”

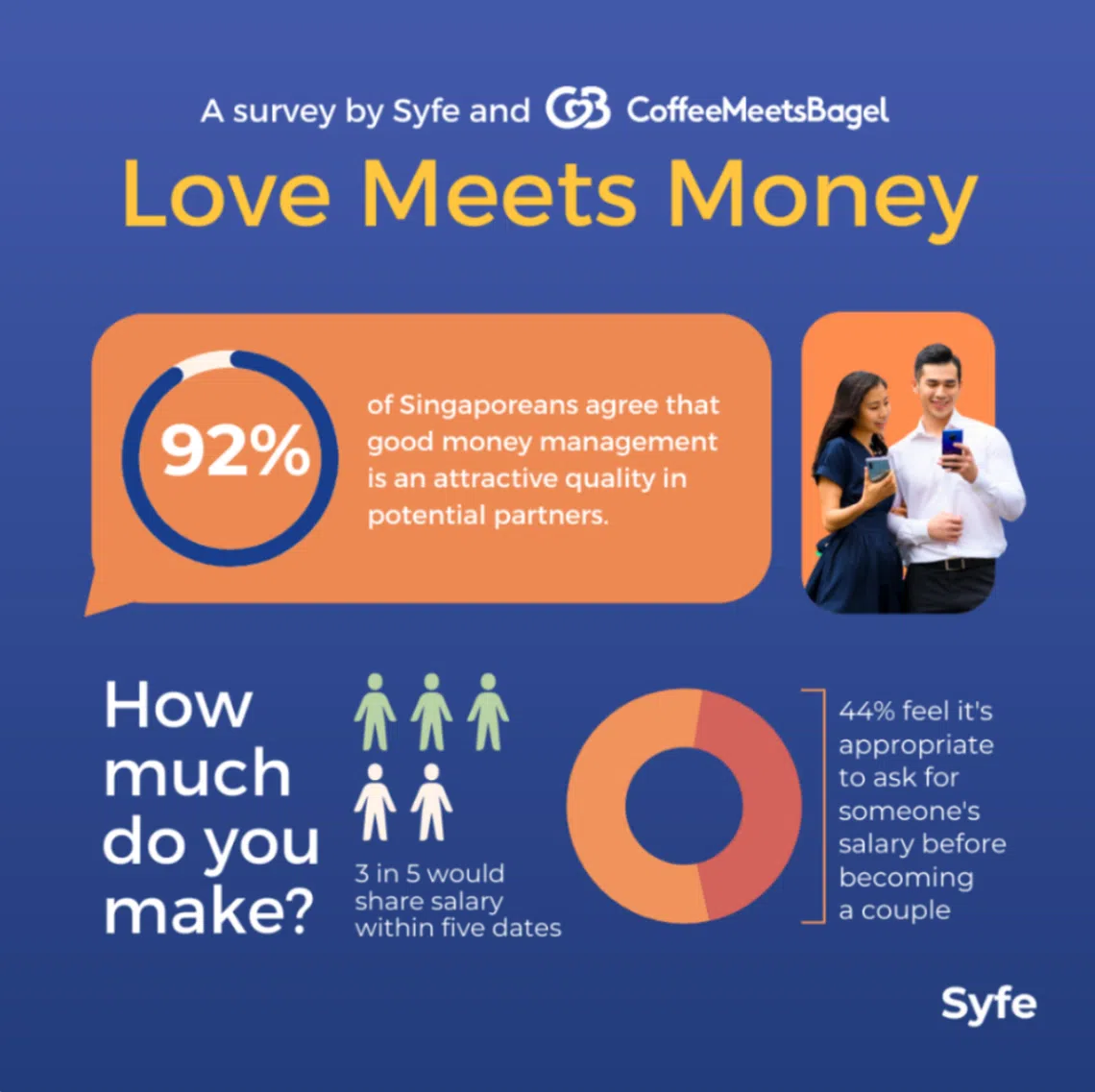

Indeed, a 2022 survey by dating app Coffee Meets Bagel and investment platform Syfe suggests that discussing finances before becoming a couple isn’t that intrusive of a question to ask.

In fact, the survey found that the majority of participants below the age of 35 didn’t find money talk to be taboo on a first date – two in five said it was a turnoff as opposed to about three in five for participants over 35.

After all, in this age of online dating, the earlier you find out that your date’s views on money aren’t compatible with yours, the earlier you can move on to your next match.

For instance, maybe he wants to hustle while he’s young and you’re content with coasting. Or perhaps she’s thrifty but your belief is that money is meant to be spent.

🚩 Red flag

A different view on money doesn’t always have to be a red flag, though. Nor does it have to be a reason for couples who have already gotten together to break up.

When these differences appear, it’s important to have a conversation about why each of you feel the way you do, come to a common understanding and see if some consensus can be worked out, says Woo.

Say you discover that your partner spends all of their salary every month. It could be that your partner simply doesn’t yet understand the importance of saving or have the know-how to better manage his or her finances.

“Is this something that this person can learn, or is it something that’s really fundamental and they’re not looking to improve their (financial) habits? If this is just their relationship with money at this point, then it’s up to you to decide whether this is a red flag,” says Woo.

When having these conversations, Woo suggests being respectful that people form their views on money based on their unique experiences – some grew up with an abundance of it; others with a lack of it.

“It’s important to remain open minded and not assume that the other person is willfully irresponsible or just a spendthrift… and understand the thinking behind the actions,” she adds.

📋 Practical tips

An important question to discuss is how the two of you are going to split the bills.

You might want to do a 50/50 split or have each person pay a proportion based on their income if one of you earns much more than the other. Many people like to take a more casual approach, where one person pays for dinner while the other pays for shopping, for example.

Whichever way you choose, the important thing is that both parties are clear of what the arrangement is to avoid any misunderstandings – or worse, resentment – when one person feels like they’re footing more than they should, says Sheryl Choong, Endowus’ Singapore head of client advisory.

As the two of you get closer to tying the knot, you’ll also need to decide whether to open a joint bank account.

This account could be used just to pay for shared expenses. Each of you can still keep your personal savings separate to pay for your individual expenses.

In that case, how much each of you contributes can be based on the spending split you decided on, Choong says.

And if the two of you decide to jointly invest for your housing or family goals, make sure that you’re both aware of what you’re investing in and that your tolerance for risk is aligned, Choong adds.

In relationships, it’s fairly common for the more financially-savvy party to take charge of all money-related issues. However, it’s important that the other person participates in this conversation as well, even if they leave it to their other half to call the shots.

After all, relationships are a partnership. “It’s still always wise to rope in your partner, ask them what they think, to let them feel that sense of, ‘We are doing this together’,” says Woo.

TL;DR

-

Conflicts can arise if a couple isn’t transparent with each other about their finances

-

Be respectful of other people’s views on money, which usually stem from their own experiences

-

The first step to discussing finances is to map out your financial goals as a couple

-

Both parties should be clear on how to split the bills or save up to meet your goals