THE Asia-Pacific region, excluding Japan, recorded a 25 per cent year-on-year decline in investment banking (IB) fees to US$9.3 billion in the first half of 2024.

This was the lowest H1 figure in the region since 2016, based on a report by the London Stock Exchange (LSEG) released on Friday (Jul 5).

Fees generated in the region accounted for 16 per cent of total fees earned globally; IB fees from America accounted for 55 per cent, and Europe, 24 per cent.

Within the Asia-Pacific (excluding Japan), China’s state-owned investment company Citic took the top position for overall IB fees, with a total of US$489.5 million. It accounted for a 5.3 per cent wallet share of the total Asia-Pacific IB fee pool.

Equity capital markets underwriting fees were down 52 per cent on the year to US$1.6 billion in the region – the lowest since 2013. Its debt capital market fees fell 5 per cent to US$5.5 billion, while syndicated lending fees tumbled 39 per cent to US$1.2 billion, compared to H1 2023.

The estimated advisory fees earned from completed mergers and acquisitions (M&As) were also down 28 per cent on the year to US$964 million in the region.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Deal-making activity for the region, also excluding Japan, also fell 22 per cent on the year to US$268.7 billion – marking the lowest semi-annual total since H1 2013.

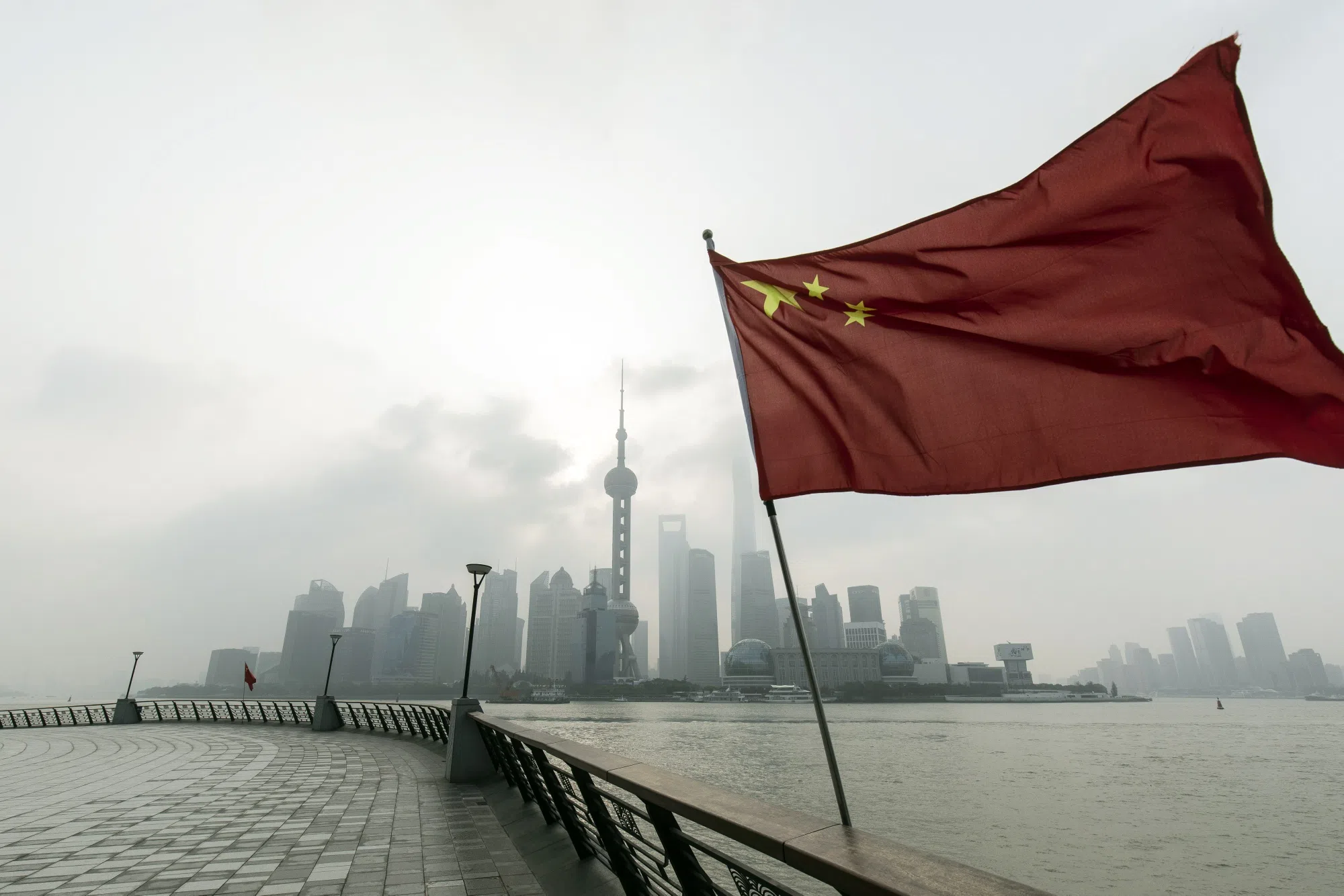

Elaine Tan, senior manager of Deals Intelligence at LSEG, said: “As one of the biggest contributors to deal making in Asia, China’s economic slowdown, combined with geopolitical tensions, heightened by regulatory scrutiny and the persistence of high interest rates particularly dampened the appetite for M&A) activity.”

She noted that there were fewer transactions over US$5 billion announced in Asia in H1 2024 and the slowing down of mid-market activity also highlights a “cautious approach” in the current economic landscape.

Target Asia-Pacific M&A came to S$226.8 billion in transactions, down 23.8 per cent from a year ago, based on LSEG’s data.

Most of the deal-making activity involving the region targeted the industrial sector, which accounted for a 16.8 per cent market share worth US$45 billion. This is also down 42.4 per cent from H1 last year.

The high-technology sector, at 14.5 per cent market share, recorded US$39.1 billion in deals, inching up 1.4 per cent on the year. The materials sector captured 12.7 per cent market share worth US$34 billion, down 40.3 per cent from a year ago.

Meanwhile, the consumer products and services, and healthcare and media and entertainment sectors recorded double-digit percentage growth from last year in terms of deal value, said LSEG.

Private equity-backed deals targeting the region rose 15.1 per cent year on year to US$52 billion. While it is the highest start to the year since 2022, LSEG noted that the number of deals fell 45.1 per cent on the year.

The region’s equity and equity-related offerings for H1 2024 amounted to US$82.6 billion, down 30 per cent from the previous year, representing the lowest H1 period since 2012.

Tan highlighted that equity and IPO activity in the region experienced significant declines as macroeconomic uncertainties, the low valuation environment and high interest rates continue to impact investor sentiment and deter blockbuster IPOs.

However, she added that despite the downturn, India stood out with a “notable increase” in equity and IPO issuances as the buoyant secondary markets encouraged new listings and additional share sales in its equity capital markets.

India accounted for 36 per cent of the region’s equity capital market proceeds, followed by China, with 32.2 per cent market share.

The region’s initial public offerings (IPOs) fell to a 15-year low. IPOs raised US$14.1 billion, down 63.7 per cent from the year before; the number of IPOs dipped by 21.4 per cent.

While Asa-Pacific IPOs accounted for 28.7 per cent of global IPO proceeds, Chinese IPOs captured 11.8 per cent, raising US$5.8 billion, down 81.7 per cent from a year ago.

Follow-on offerings fell to a five-year low and totalled US$54.6 billion, down 16.8 per cent on the year. This is despite an 8.1 per cent increase in the number of follow-ons, because deals were done in smaller sizes, said LSEG.

While convertible bonds raised US$13.9 billion, up 2.7 per cent year on year, the number of convertibles fell by 68.9 per cent.

Citi currently leads Apac’s equity capital market underwriting rankings, with a 9 per cent market share and US$7.5 billion in related proceeds, said LSEG.

Issuers domiciled in the Asia-Pacific raised US$1.9 trillion in bond proceeds in the first half of 2024, inching down 1.4 per cent from a year ago.

China accounted for 79.1 per cent of the region’s bond proceeds, at US$1.5 trillion, down 1.8 per cent from the year before. South Korea followed with a 7 per cent market share; its bond proceeds grew 2.2 per cent to US$138.1 billion. Australia and India accounted for 5.3 per cent and 2.1 per cent market share, respectively.

Bond offerings from the government and agency sectors captured 39.3 per cent of the market, amounting to US$765.4 billion, down 15.1 per cent from the previous year.

Financials made up 38.2 per cent of the region’s bond proceeds and totalled US$743.3 billion, up 10.3 per cent from the year before.

Industrials accounted for 9.5 per cent market share worth US$184.8 billion, up 17.2 per cent on the year.

China’s Citic leads Asia-Pacific-issued bond underwriting, representing 6.3 per cent market share with related proceeds of US$123.2 billion.