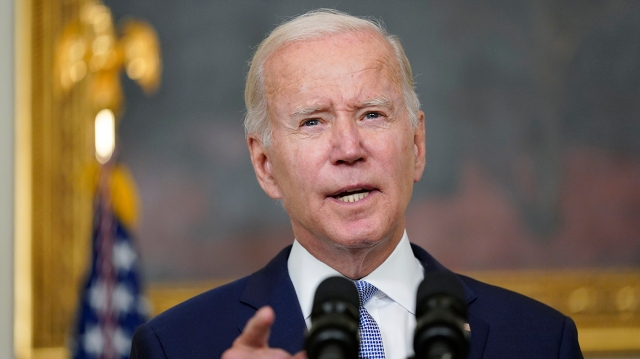

President Joe Biden is about to launch a student loan waiver program that is estimated to cost the taxpayers more than $300 billion. The move will offer relief to more than 43 million Americans who have availed of student loans, but the issue has been politically divisive.

The loan waiver program has been anticipated for long and Biden will aim to use the move to shore up his flagging approval ratings. The exact details of the plan are not available yet, and Biden is slated to make an announcement on Wednesday.

Nick Youngson/Picpedia

Details

A one-time maximum waiver of $10,000 for students who make less than $125,000 will incur a cost of $300 billion, while the plan will cost around $330 billion if the scheme is applied for the standard 10-year window, according to calculations made by the Penn Wharton Budget Model. According to federal data, nearly a third of the students who have taken loans owe less than $10,000, and more than half owing less than $20,000.

The federal loan waiver program has been a divisive issue, with Biden’s Democrats vouching for it while the Republicans see it as a needless expansion of the government. At the moment federal student debt in the United States stands at $1.6 trillion.

Biden’s original campaign promise was to waive loans up to $10,000 per borrower irrespective of their income. However, of late the president has mulled tinkering with the plan to add an income cap considering that people whose incomes are higher will be less hard hit than others from the pandemic.

There have been concerns among economists that runaway US inflation will be worsened by the federal loan forgiveness plan.

Loan Forgiveness and Inflation

“Debt cancellation would boost near-term inflation far more than the IRA will lower it … $10,000 of debt cancellation could add up to 15 basis points up front and create additional inflationary pressure over time,” an analysis by the Committee for a Responsible Federal Budget (CRFB), said, according to Fox News.

The US economy contracted in the first quarter at a faster rate than anticipated earlier, according to the Commerce Department’s data. The world’s largest economy shrank at an annual rate of 1.6 percent in the first quarter, data showed in June.

The US Federal Reserve started hiking interest rates in March after following a loose monetary policy for months in the wake of the Coronavirus pandemic and the economic shocks from the global crisis.

PXhere

Analysts expect the US central bank to continue to tighten rates up until the end of the year, despite fears that this will push the US into recession. Higher rates will cool off inflation by limiting spending and loan offtake. But a resultant cooling off of demand will push economic growth lower, threatening the onset of a recession.

Inflation in the US went up to 9.1 percent in June but slowed down marginally to 8.5 percent in July.