America is being promised something politicians rarely dare to guarantee: more money in your pocket. Not in theory. Not in a 10-year forecast. But real, tangible cash when tax refunds land in 2026. The Trump administration describes it as a ‘feast and a banquet’. Critics, however, warn it’s a sugar rush the country simply cannot afford.

Both perspectives may hold some truth.

Behind the spectacle of the ‘One Big Beautiful Bill Act’ lies a straightforward political calculation: optimism can be a powerful vote-winner. After years of inflation fatigue and rising concerns over affordability, Trump is betting that larger refunds will ease public discontent—at least long enough to see him through the midterm elections.

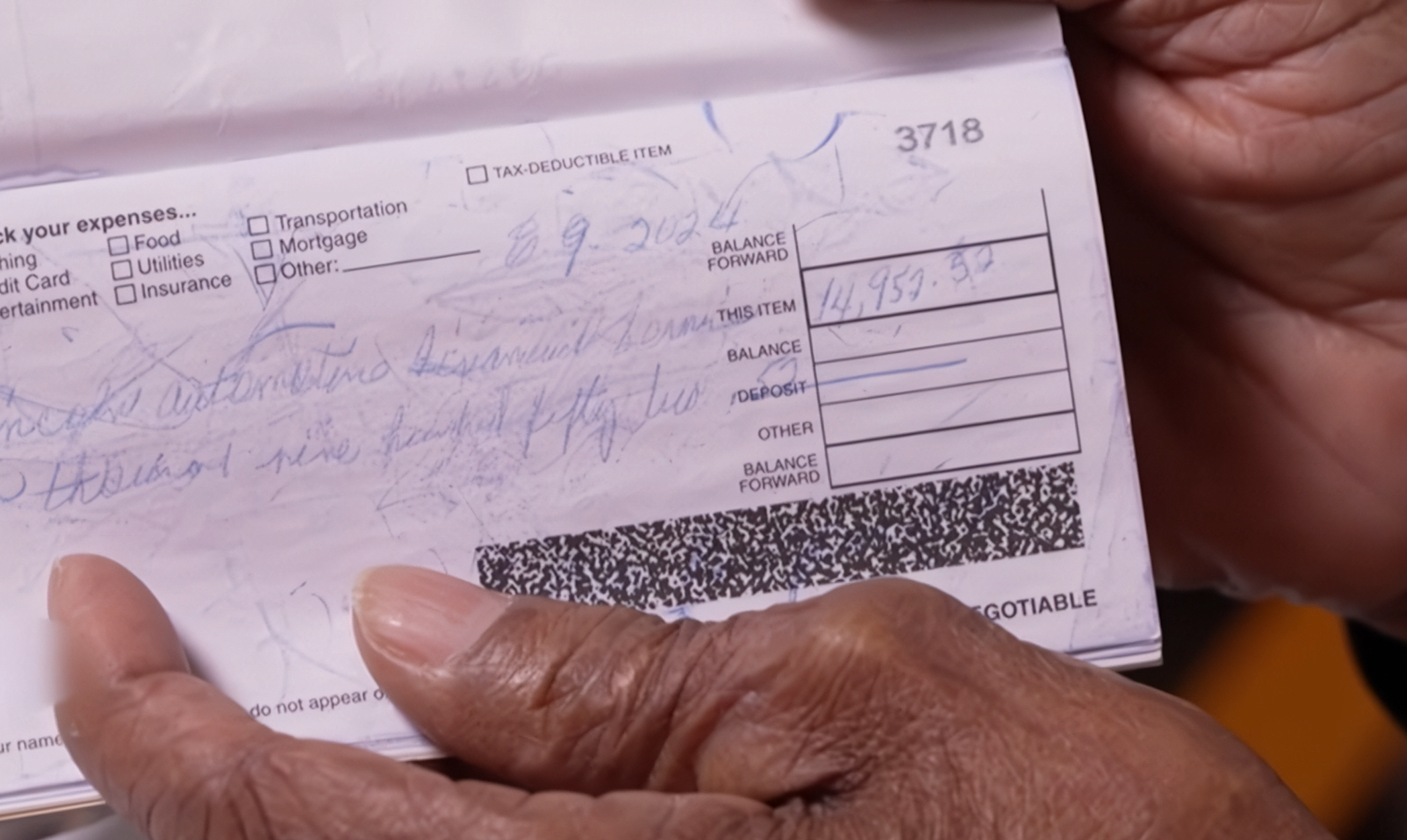

Technically, the changes take effect with 2025’s earnings; however, the real impact will be felt by those filing their taxes and noticing their income figures. The Tax Foundation estimates that consumers could see over a 5% increase in after-tax earnings. This boost not only suggests improved economic conditions for many households but could also stimulate increased consumer demand due to greater purchasing power. Since approximately 70% of the US economy relies on consumer spending, the more people are able to spend, the more likely the economy will grow in the short term.

Who Really Benefits?

The political narrative suggests that these changes mainly benefit the wealthy. Yet, the reality is more complex. While many earning between $55,000 and $100,000 (upper-middle income) will see proportional gains, other groups will also benefit. Tipped employees, overtime workers, and pensioners are all set to gain from certain provisions.

For example, the allowance for tax-free tips of up to $25,000 is a significant change that could transform how hospitality staff are paid. Similarly, provisions enabling tax-free overtime for tradespeople and emergency workers who work long hours will provide targeted relief. Many seniors, who have quietly slipped into lower tax brackets over the years, may find themselves entirely freed from tax liabilities.

Targeted Relief, Not Trickle-Down

However, the bill’s absence from the victory lap is telling. Extending Trump-era tax rates, expanding deductions, and eliminating targeted credits does not mean the costs are gone; rather, they are deferred. The increase in debt is not immediately obvious, and the widening of inequality unfolds gradually.

Raising the SALT deduction cap to $40,000 will benefit high-tax states by allowing taxpayers who itemise deductions to save more. Yet, this primarily benefits those in wealthier brackets; for lower-income households, the gains are minimal. Initially, the refunds may seem like a universal windfall, but the long-term consequences are less positive.

Politics Dressed as Policy

This suite of economic policies, developed during the Trump administration, carries a clear political intent. Economically, it appears designed to foster confidence and goodwill towards his administration through tax incentives. Critics argue that this approach is fiscally irresponsible, while supporters point to steady economic growth as evidence of its effectiveness.

In essence, the policy aims to boost the economy and secure political support, but at what long-term cost? The immediate perception of a tax windfall masks deeper issues of mounting debt and growing inequality, which may only become apparent further down the line.

Originally published on IBTimes UK