Bitcoin broke $100,000 for the first time Thursday as traders cheered Donald Trump’s decision to pick a crypto fan to head the US securities regulator, reinforcing optimism the new president will push through measures to deregulate the sector.

The cryptocurrency soared through the mark, having enjoyed a blistering rally since the November 5 election of Trump, who pledged on the campaign trail to make the United States the “bitcoin and cryptocurrency capital of the world”.

The digital unit has jumped more than 50 percent since the tycoon’s victory — and around 140 percent since the turn of the year.

However, the unit’s advance — it hit a record of $103,800.44 before easing to just below $103,000 in the afternoon — had stalled in recent weeks, sitting just below $100,000 as traders awaited new catalysts to buy in.

That came with news that Trump has fingered major crypto proponent Paul Atkins to take over as chair of the Securities and Exchange Commission.

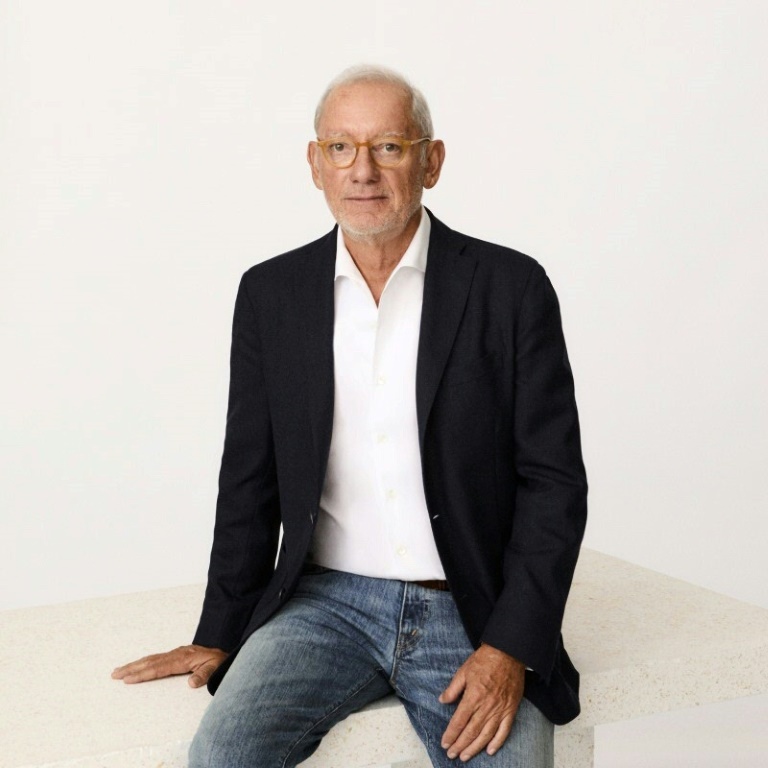

Atkins, an SEC commissioner from 2002 to 2008, founded risk consultancy firm Patomak Global Partners in 2009, whose clients include companies in the banking, trading and cryptocurrency industries.

An announcement from the Trump transition team noted that Atkins had been co-chairman of the Digital Chamber of Commerce, which promotes the use of digital assets, since 2017.

“Paul is a proven leader for common sense regulations,” Trump said in a statement that emphasised Atkins’ commitment to “robust, innovative” capital markets.

“He also recognises that digital assets and other innovations are crucial to Making America Greater than Ever Before,” Trump added.

He would replace Gary Gensler, who led a crackdown on the sector after a 2022 market rout.

Even so, the SEC this year authorised the trading on the American market of two new financial products, allowing a wider public to buy cryptocurrencies, called ETFs.

“Atkins, a conservative legal eagle with a track record of critiquing the SEC’s tough stance on cryptocurrency firms, is expected to steer a more crypto-friendly course,” said Stephen Innes at SPI Asset Management.

“This strategic move has electrified the crypto community, fueling investor optimism about a potentially more accommodating regulatory landscape under Atkins’ watch, aligning with broader Republican advocacy for a lenient approach to the flourishing digital asset market.”

Despite having once branded cryptocurrencies a “scam”, Trump changed his stance and has been a major advocate of the unit during his election campaign.

In September, he announced that he, along with his sons and entrepreneurs, would launch a digital currency platform named World Liberty Financial.

He has also become a close friend of tycoon Elon Musk, who he said would lead a new US government-efficiency group tasked with cutting federal waste.

Musk reportedly spent more than $100 million to help Trump regain the White House, repeatedly boosting his candidacy on his X social media platform.

Reacting on X to the news of Bitcoin hitting the $100,000 mark, Musk wrote: “Wow”.

“Layer on top expectations he will strip back regulations on the crypto industry and you begin to understand why investors have piled into the digital currency and related stock,” said Dan Coatsworth, an analyst at investment group AJ Bell.

Among the measures expected from the sector is the creation of a strategic reserve of bitcoins in the United States, consisting mainly of tokens seized by the courts, which could push other countries to grant more legitimacy to the virtual currency.

And Samer Hasn, of XS.com, added that the prospect of relaxed regulation was fuelling “the hope of seeing cryptocurrencies integrate more deeply into the economic life” of the country.

Cryptocurrencies have made headlines since their creation, from their extreme volatility to the collapse of several industry giants, foremost among them the FTX exchange platform.

Bitcoin was conceived in 2008 by a person or group writing under the name Satoshi Nakamoto.

It was pitched as a way to break free of mainstream financial institutions by establishing a decentralised platform for transactions.

The digital currency is created — or “mined” — as a reward when powerful computers solve complex problems to validate transactions made on a meddle-proof register known as the blockchain.

Bitcoin has long been criticised for being the currency of choice for making untraceable payments on the dark web, the hidden part of the internet used for criminal activities.

The asset has often come under attack for facilitating money laundering and allowing extortion through ransomware attacks.

In September 2021, the unit was accepted by El Salvador as legal tender, though according to a study by Central America University, in 2023, 88 percent of Salvadorans never used it.