Published Fri, Feb 6, 2026 · 06:13 AM

[NEW YORK] Bitcoin plunged on Thursday, its decline accelerating amid weakening risk sentiment driven in part by volatility in precious metals and a broad selloff in tech shares.

The world’s largest cryptocurrency fell to a low of US$63,295.74, its weakest level since October 2024, a month before Republican Donald Trump won the US presidential election, having signalled his intention to support crypto on the campaign trail.

It was last down 12.6 per cent at US$63,525, on track for its largest one-day fall since November 2022.

Roughly US$1 billion in bitcoin positions have been liquidated in the past 24 hours, according to data from CoinGlass.

All told, the global crypto market has lost US$2 trillion in value since hitting a peak of US$4.379 trillion in early October, CoinGecko data showed, with some US$800 billion wiped out in the last month alone.

Bitcoin has already fallen 17 per cent for the week, taking its losses for the year so far to 28 per cent. Ether, the second-largest cryptocurrency in terms of market capitalisation, was down more than 13 per cent at US$1,854 late on Thursday. Ether has fallen 19 per cent this week, with losses of nearly 38 per cent so far this year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Sentiment on crypto was affected by the latest selling in metals and stocks. Gold and silver, for instance, have become more volatile as a result of leveraged buying and speculative flows. Silver, for one, fell as much as 18 per cent to a low of US$72.21.

In equities, the S&P 500 sank to a seven-week low, while the Nasdaq slid to its lowest in more than two months on Thursday, as the AI theme came under renewed pressure.

“It’s clear the crypto market is now in full capitulation mode,” said Nic Puckrin, investment analyst and co-founder of Coin Bureau. “If previous cycles are anything to go by, this is no longer a short-term correction, but rather a transition from distribution to reset – and these typically take months, not weeks.”

The latest crypto tumble has knocked down shares of companies holding bitcoin and other digital assets, stoking worries that the market turmoil is spreading beyond token prices.

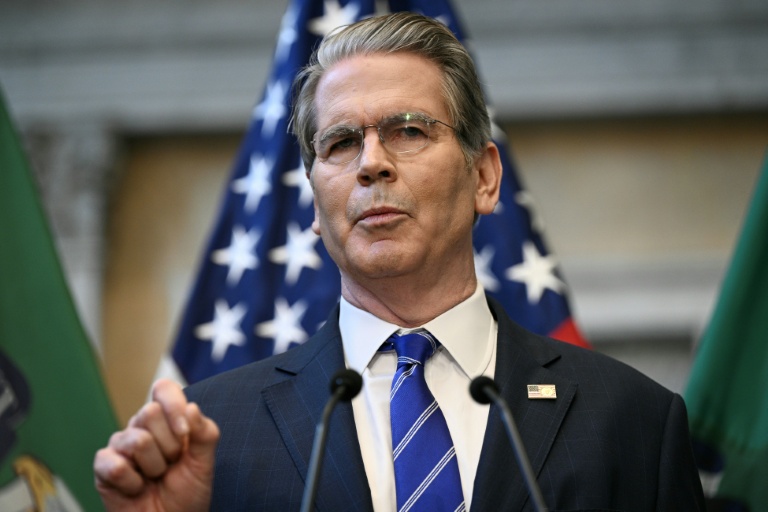

Markets ‘fear a hawk’ with Warsh

Trump’s selection of Kevin Warsh as his pick to become the next Federal Reserve chair has also fuelled the latest rout in cryptocurrencies, some analysts said, due to expectations he could shrink the Fed’s balance sheet.

Cryptocurrencies have widely been regarded as beneficiaries of a large balance sheet, having tended to rally while the Fed greased money markets with liquidity – a support for speculative assets.

“The market fears a hawk with him,” said Manuel Villegas Franceschi from the next generation research team at Julius Baer. “A smaller balance sheet is not going to provide any tailwinds for crypto.”

To be sure, cryptocurrencies have struggled for months since a record crash last October sent bitcoin tumbling from a peak as leveraged positions got washed out. That has left investors less keen on digital assets and sentiment toward the industry fragile.

“We believe this broader decline is mainly driven by massive withdrawals from institutional ETFs (exchange traded funds). These funds have seen billions of dollars flow out each month since the October 2025 downturn,” Deutsche Bank analysts said in a note to clients.

They added that US spot bitcoin ETFs witnessed outflows of more than US$3 billion in January, following outflows of about US$2 billion and US$7 billion in December and November respectively.

“This steady selling in our view signals that traditional investors are losing interest, and overall pessimism about crypto is growing,” the analysts said.

Broader issues in tech sector

Bitcoin’s fortunes have been tied to the broader tech sector for some time. The price tended to rise, particularly on the back of investor enthusiasm over artificial intelligence.

This week’s rout in global software stocks has accelerated the slide in the value of bitcoin, ether and other tokens.

Market watchers are starting to question if this decline marks the start of a steeper correction.

“Concerns are being raised around the crypto miners and whether we could be looking at forced liquidations if prices continue to fall, which could lead to a vicious cycle,” Jefferies strategist Mohit Kumar said in a note.

“Our view on crypto has always been that it should be never more than a very small portion of the overall portfolio. However, it is also an asset class that is heavily owned, particularly by retail investors, and hence adds to the overall market risk,” Kumar said. REUTERS

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.