After amassing over 11,000 BTC within just 48 hours of its iShares Bitcoin Trust debut on the Nasdaq stock exchange, BlackRock CEO Larry Fink revealed the company’s plan to usher “technological revolution in the financial markets,” which not only involves Bitcoin but all other crypto and financial assets.

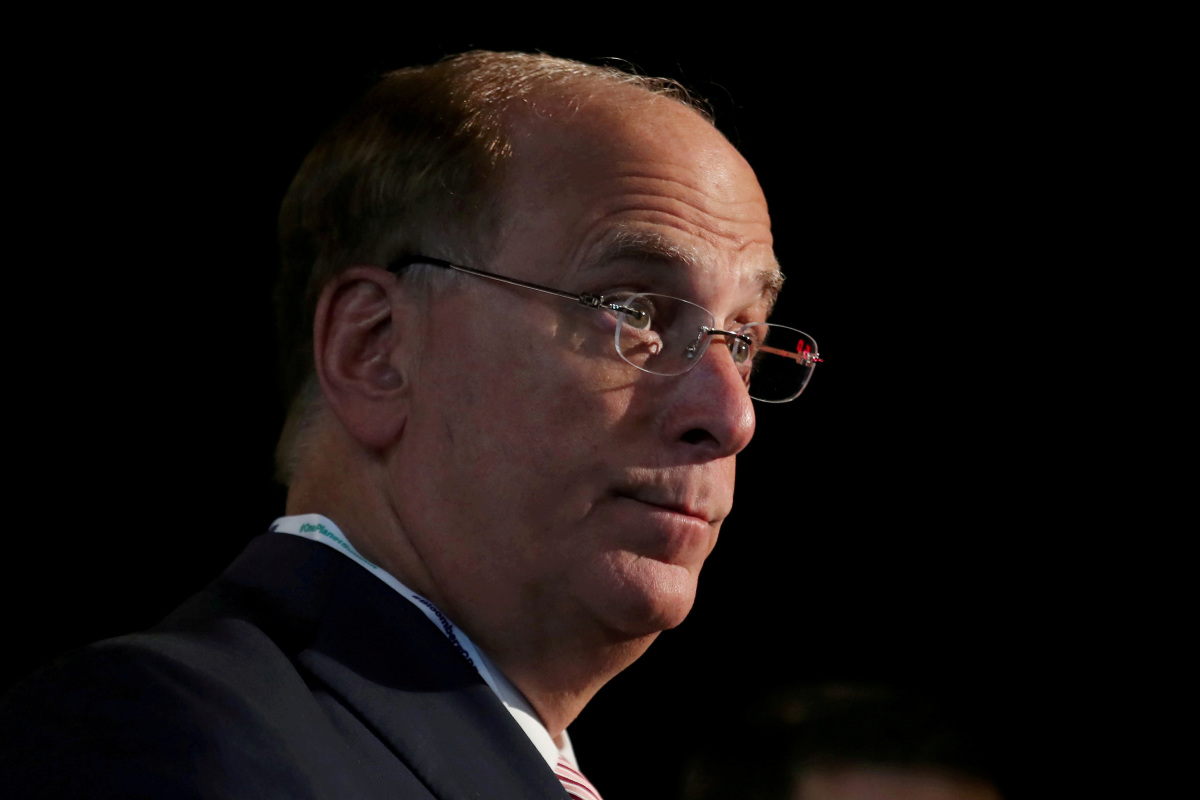

Fink, the chief executive officer of the world’s largest asset management firm, was not a fan of Bitcoin and even labeled Bitcoin in 2017 as an “index of money laundering.”

But the 71-year-old American billionaire businessman is now singing a different tune and after the successful launch of iShares Bitcoin Trust (IBIT), BlackRock’s spot Bitcoin ETF, shared the firm’s plan to effect a technological revolution in finance.

“ETFs are step one in the technological revolution in the financial markets,” the BlackRock CEO said. “Step two is going to be the tokenization of every financial asset.”

Blockchain technology, the foundation of Bitcoin and other cryptocurrencies, enables the digitization or tokenization of conventional assets onto a publicly accessible ledger.

This advancement has the potential to streamline and reduce the cost of transactions involving a variety of assets, including stocks, bonds, real estate, and even alternative investments such as artwork.

“We have the technology to tokenize today,” the CEO of the largest money-management firm in the world with more than US$10 trillion in assets under management said.

“If you had a tokenized security … the moment you buy or sell an instrument, it’s known it’s on a general ledger that is all created together. This eliminates all corruption, having a tokenized system,” he added.

Fink also mentioned that Ether exchange-traded fund (ETF) has value.

“I see value in having an ETH ETF,” Fink noted. “As I said, these are just start stepping stones toward tokenization.”

In November 2023. BlackRock’s plan was revealed in a filing by Nasdaq, the U.S. exchange where BlackRock will list the product.

The company has already registered the iShares Ethereum Trust in the state of Delaware with Coinbase crypto exchange as the product’s custodian and an unnamed party to hold its cash.

“Either CME surveillance can detect spot-market fraud that affects both futures ETFs and spot exchange-traded products, or that surveillance cannot do so for either type of product,” the BlackRock’s filing reaqd.

“Having approved ETH futures ETFs in part on the basis of such surveillance, the Commission has clearly determined that CME surveillance can detect spot-market fraud that would affect spot ETPs, and the Sponsor thus believes that it must also approve spot ETH ETPs on that basis.” the filing further noted.