The long-drawn US debt limit crisis appears to have blown over, with President Joe Biden and Congress Speaker Kevin McCarthy edging closer to a deal on the US government’s spending cuts. As per the deal in the works, the US government’s debt limit will be raised to $31.4 trillion for two years, Reuters reported, citing top government officials.

The Current Debt Limit

The current US government debt limit stands at $31.4 trillion. In August 2021, when the government stared at a shut down, the debt limit was $28.4 trillion. Congress enhanced the limit on December 14, 2021 to around $31.4 trillion. It was projected at that time that the limit would be breached sometime in 2023.

Lars Di Scenza / Wikipedia Commons

It was reported earlier on Thursday that the two sides were dead-locked on the details about the plan to cut the US government’s discretionary spending. While the Republicans wanted the cut on discretionary spending to be in place for five years, the White House would not agree for more than two years.

Differences Over Discretionary Spending

The discretionary spending was around $1.7 trillion in 2022, accounting for about 27 percent of the US federal budget. Most of this spending was on defense-related matters, and hence the White House is not keen on steep cuts that lasts more than two years.

It is not clear how this contentious issue has been sorted, but details are set to emerge in due course. “The White House is considering scaling back its plan to boost funding at the Internal Revenue Service to hire more auditors and target wealthy Americans, the official said,” Reuters reported.

According to the deal, the details on how the government can cut spending on discretionary programs like housing and education will have to emerge. “The two sides are just $70 billion apart on a total figure that would be well over $1 trillion, according to another source,” the report adds.

“I don’t think everybody’s going to be happy at the end of the day. That’s not how the system works,” McCarthy said.

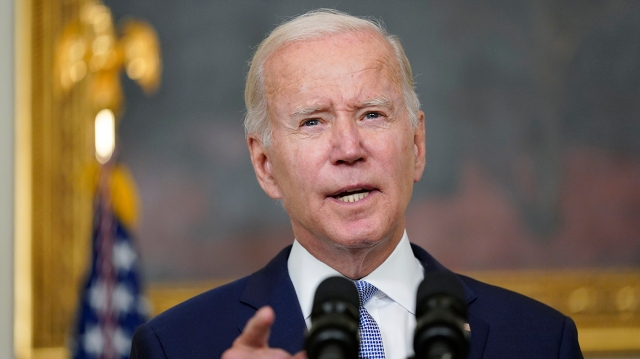

Biden said earlier on Thursday that the negotiations were at a point where an agreement would be arrived at. “I don’t believe the whole burden should fall back to middle class and working-class Americans,” Biden said, referring to the differences over which areas to be focused for spending cuts.

Reuters

How a Default Happens

According to the Treasury Department, the US government will slip into default by June 1 unless the government and the Republican-controlled Congress agree on raising the government’s debt limit. When the government hits the debt ceiling, it cannot spend more unless the limit is enhanced or suspended. Technically, the limit prevents the Treasury Department to issue more Treasury bonds to bring in money. At this point it will have a tough choice – either to stop paying federal employee salaries and social security payments or stop paying the interest on the national debt. Both choices are tough and if the government is forced to keep spending on salaries and benefits, it will fail to pay interest on national debt, leading to a default.

US Has Never Defaulted

The US government has never defaulted in its interest in payment commitments. According to Treasury Secretary Janet Yellen, a US default could happen on June 1 if the Congress does not reach a deal by then to raise the top limits for the government’s borrowing. However, according to a nonpartisan Congressional Budget Office forecast, the limit will be breached only on June 15.