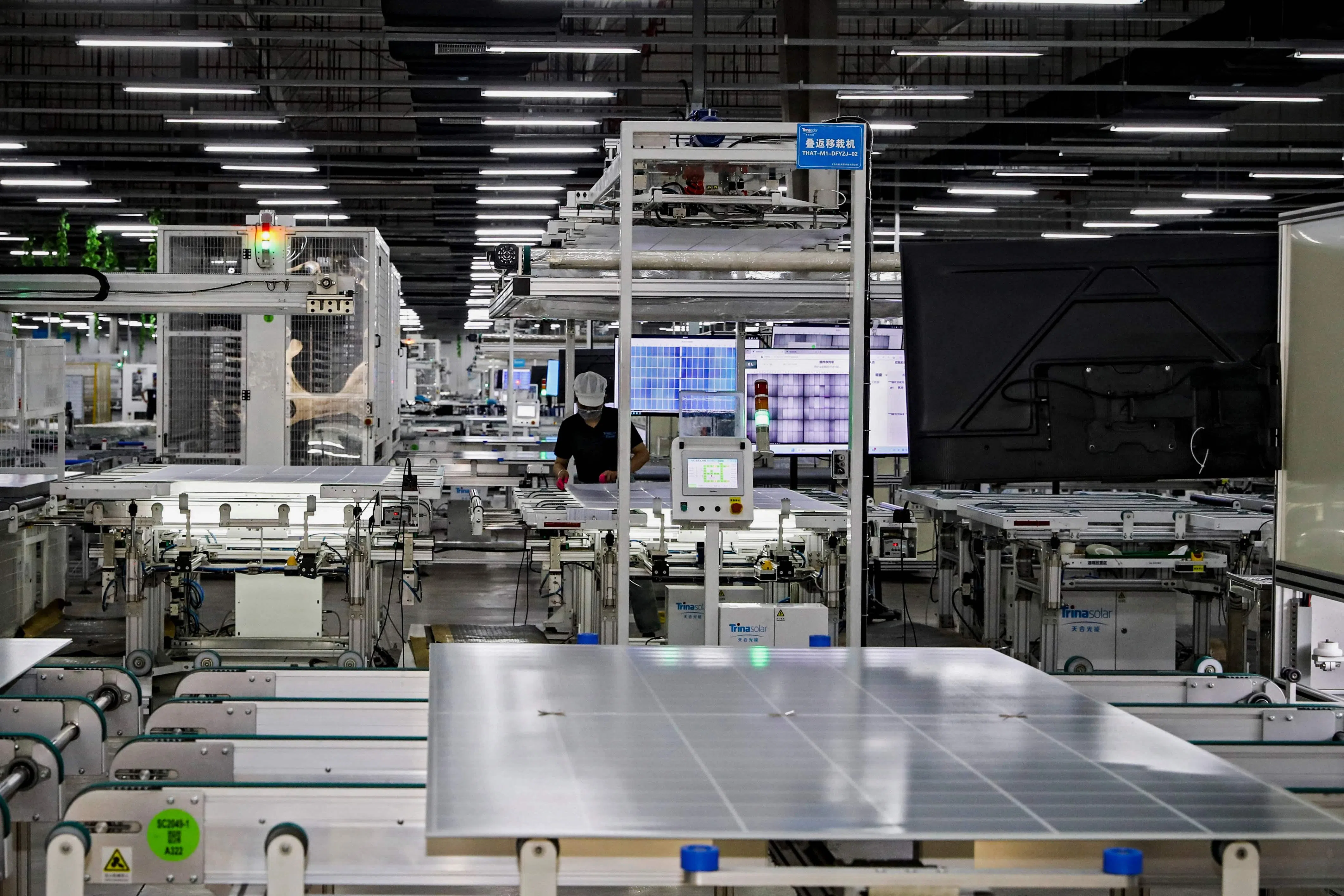

Chinese solar panel manufacturers said they are seeking immediate government intervention to curb investment and industry collaboration to arrest a plunge in prices of solar cells and modules, as the industry faces overcapacity.

Financial incentives and a government push have helped China become the solar panel factory of the world, accounting for about 80 per cent of global module capacity. Analysts expect Chinese manufacturers to add up to 600 gigawatts (GW) this year, enough to meet global demand through 2032.

However, with no end in sight for the plunge in prices, industry officials and analysts said intense competition was threatening to drive smaller producers into bankruptcy. Rapid capacity additions drove down prices of China’s finished solar panels by 42 per cent last year.

“Survive – that’s the goal,” Li Gang, chairman of Seraphim Energy Group said at the International Solar Photovoltaic and Smart Energy conference on Tuesday (Jun 11).

Between June 2023 and February 2024, at least eight companies cancelled or suspended more than 59 GW of new production capacity, equivalent to 6.9 per cent of China’s total finished panel production capacity in 2023, according to the China Photovoltaic Industry Association (CPIA).

“We need to join our forces together to avoid overinvestment,” Gao Jifan, chairman and chief executive officer of Trina Solar and honorary president of CPIA, told the conference.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Gao sought government regulation of new investment in the sector to plug further losses, while SiNeng Electric’s president Duan Yuhe asked the Chinese state planner to intervene.

Gongshan Zhu, chair of the Asian Photovoltaic Industry Association, warned new companies against rushing into the sector, saying industry profits had plunged 70 per cent due to overcapacity and falling prices, while exports were curbed by trade barriers imposed by the United States.

“If you’re just a copycat, it will not be sustainable for you,” Zhu said, adding that the situation has been exacerbated by local governments investing for the sake of boosting employment.

Industry executives speaking at the conference also called for an end to race-to-the-bottom price competition, and suggested bidding processes take into account levels of research and development, instead of just pricing.

Some company officials, such as Wuxi Suntech Power chairman Fei Wu, said consolidation had already begun. The industry’s prospects were expected to worsen this year, and more small companies were likely to go out of business, he added. Reuters