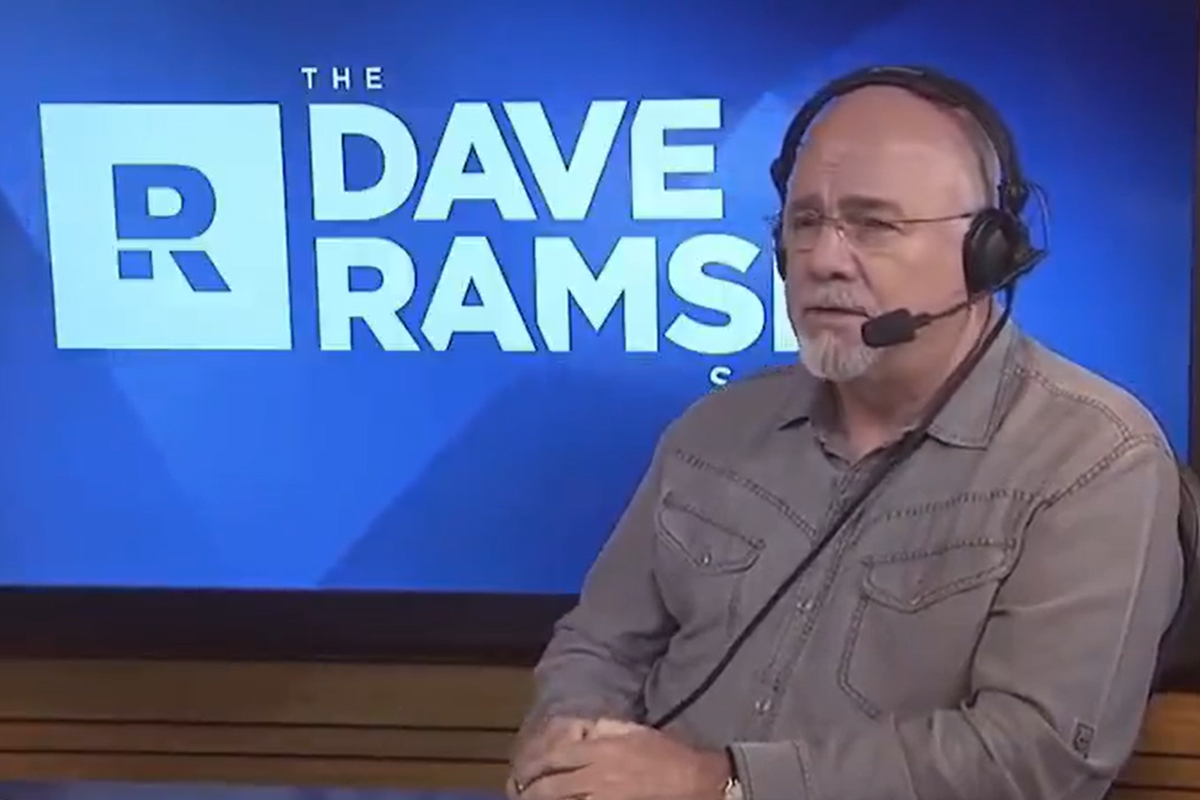

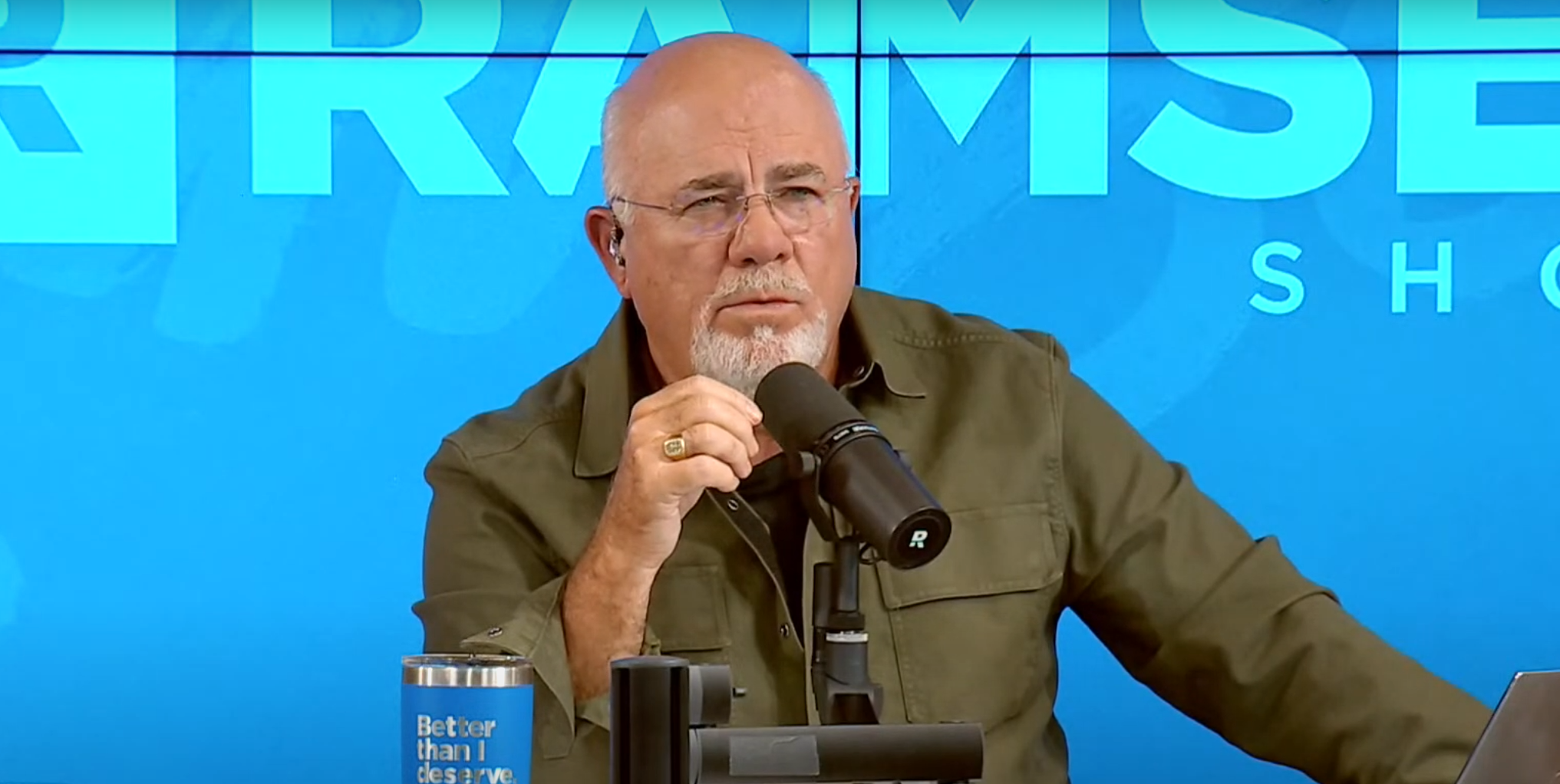

Her husband’s debt problems compelled a woman to call The Dave Ramsey Show and seek advice on whether she should file for bankruptcy with him and take over the bills, or simply walk away from the relationship.

‘My husband has basically ruined us financially. I’m at a breaking point where I need to know if we need to file for bankruptcy, if I should take over the bills and, if I do, how to start, because I’ve never handled them before. Or if I should just walk away because I’m overwhelmed,’ the woman said, adding that calls from lenders were becoming increasingly aggressive and she needed help.

When financial guru Dave Ramsey asked how much debt the couple had, the caller said it could be up to $50,000. Her breaking point came in 2025, when her husband had her car repossessed. He panicked and asked his mother to co-sign, but the car was in the caller’s name, which damaged her credit score. ‘Now his mother is contacting me saying, “The car payment is one day late — pay it today,”‘ the caller said.

When Ramsey asked why the caller had not become more involved, she said she had tried tracking the finances with her husband, but it had not worked for long. When she asked her husband — who works between 50 and 80 hours a week — why the bills were paid late, he told her the money simply was not there.

Ramsey said he could not understand why the caller was ‘standing back’ rather than taking a more active role. ‘All you’ve got to do is walk in there and sit down with him, and the two of you get out a yellow pad and figure this out,’ Ramsey said.

US Couples are Increasingly Avoiding Money Talk

A survey by the American Psychological Association found that money causes stress in relationships for 72% of US couples, with many avoiding discussions about it altogether. They sidestep conversations about finances, hoping silence will reduce tension, when in reality it often makes matters worse. A 2024 study by Cornell University also found that the greater the financial stress in a relationship, the more likely couples were to avoid discussing it.

One of the most important steps individuals can take to improve communication with their spouses is to develop respectful listening skills, which requires effort. Being honest and clear about one’s intentions also helps partners identify differences and fosters a healthier household environment.

Scheduling regular ‘money dates’ — setting aside time each week to focus on finances — and setting aside the emotional baggage carried from childhood experiences of their parents’ financial habits can go a long way towards resolving current financial issues.

Setting short- and long-term financial goals together, and seeking a spouse’s counsel when making financial decisions, is crucial because both partners will experience the consequences of household financial choices.

Finally, it is important to enjoy life’s small pleasures. Maintaining a sense of humour can help couples stay focused despite mounting financial pressures. Overall, healthy humour and shared experiences can relieve stress and ease communication.

Originally published on IBTimes UK