EUROPEAN stocks closed at a one-week low on Wednesday, hurt by a sell-off in automakers following a report about possible Chinese tariffs on imported cars, while tech stocks ticked higher ahead of US-based Nvidia’s results.

European automakers fell 1.4 per cent to a more than three-month low, with shares of Mercedes-Benz, BMW and Volkswagen falling between 0.7 per cent and 1.7 per cent.

China should raise its import tariffs on large petrol-powered cars to 25 per cent, a government-affiliated auto research body expert told China’s Global Times newspaper, as the country faces sharply higher US auto import duties and possibly additional duties to enter the European Union.

The European Commission launched an investigation in October into whether fully-electric cars manufactured in China were receiving unfair subsidies and warranted extra tariffs. The EU could impose provisional duties in July.

The Europe-wide Stoxx 600 index dipped 0.3 per cent, also pressured by a tick up in sovereign bond yields after data showed UK inflation eased less than expected in April.

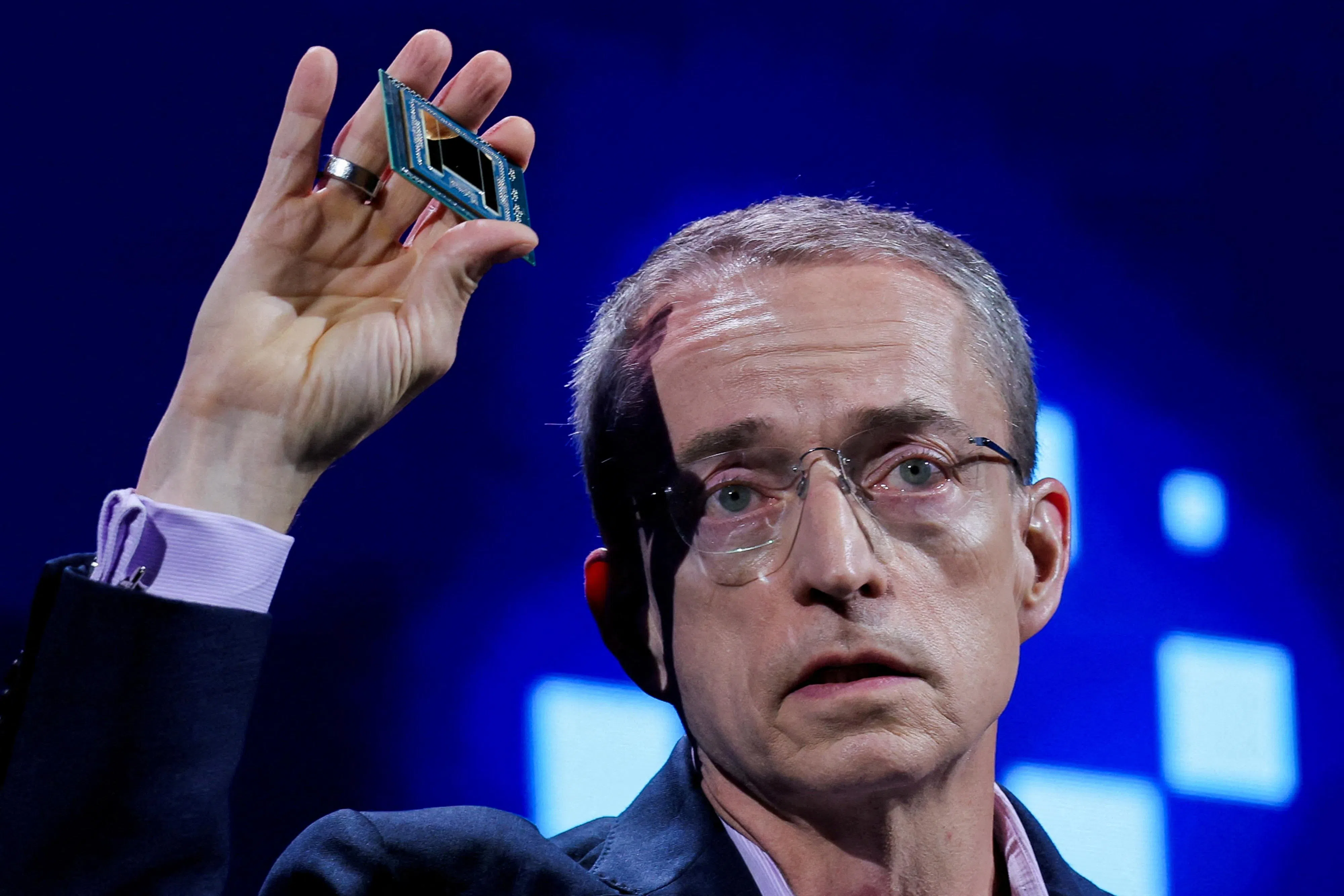

Tech stocks were a bright spot, up 0.6 per cent as investors awaited quarterly results from AI darling Nvidia later in the day to gauge if the recent market rally could continue.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“Global semiconductors is definitely one area that we see strongly benefiting from this sustained AI demand and to some extent some European companies can benefit,” said Maximilian Kunkel, chief investment officer for Global Family & Institutional Wealth at UBS.

“The big story that we’ve seen in terms of earnings delivery so far is that we’re seeing a narrowing of the gap between the United States and the euro zone.”

A surge among European tech stocks following an upbeat outlook from Nvidia in February helped the benchmark Stoxx index hit an all-time high for the first time this year.

However, a Reuters poll showed a rally in European shares has made them more vulnerable to possible pull-backs in the latter part of 2024, although signs of economic recovery and the start of a rate-cutting cycle could push them back to new peaks in the following year.

Elsewhere, the luxury sector dropped over 2 per cent to mark its worst day in over three months.

Swiss Life dipped 2 per cent after Switzerland’s largest life insurer narrowed its 2024 outlook for fee income.

Marks & Spencer jumped 5.1 per cent after the British retailer beat forecasts with a 58 per cent rise in annual profit. REUTERS