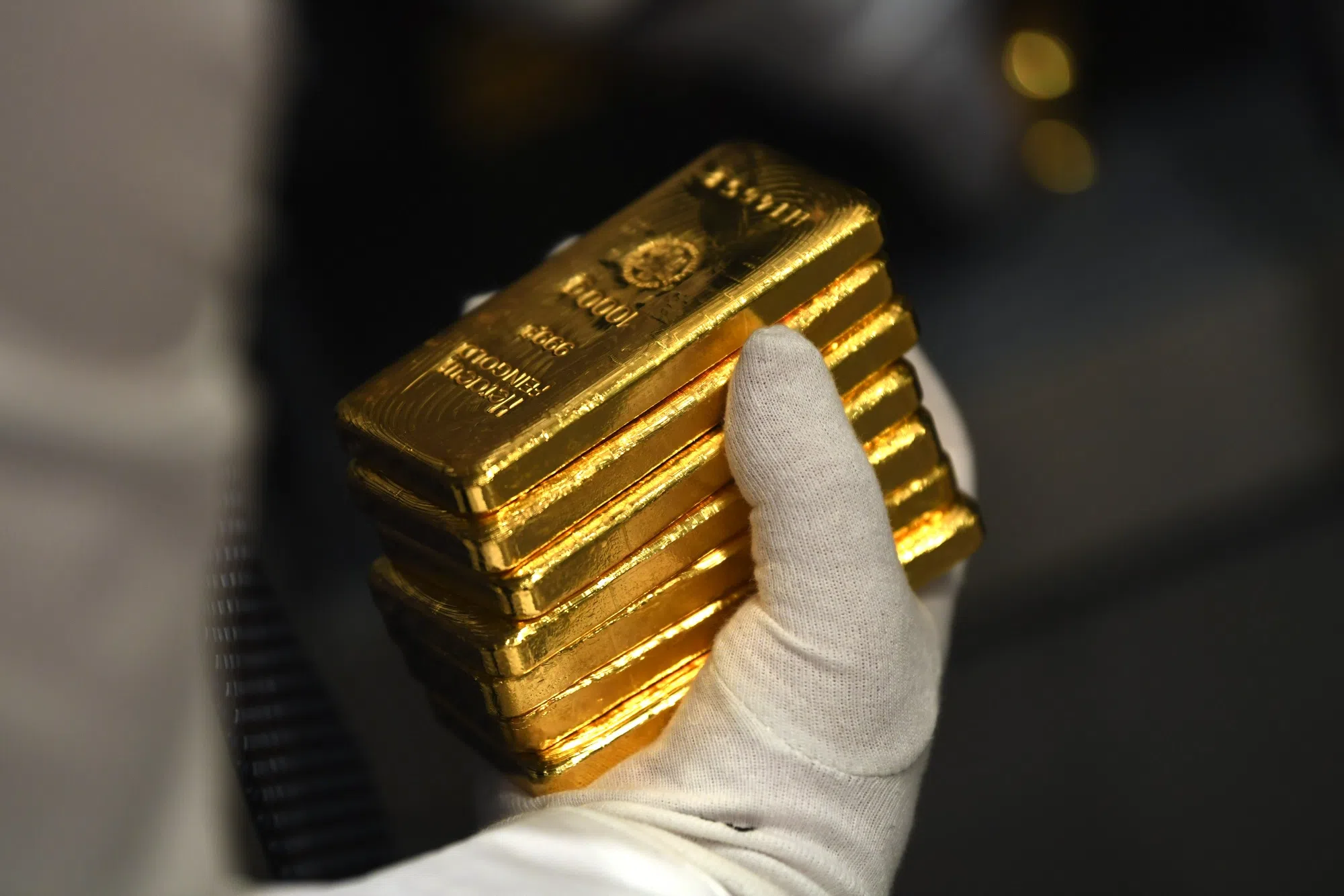

GOLD held steady near its record high on Thursday (Jan 23) as investors awaited further direction from the new Trump administration regarding potential tax cuts and trade policies.

Spot gold held its ground at US$2,755.68 per ounce, as at 0043 GMT. Prices rose to US$2,763.43 on Wednesday, their highest since Oct 31 when they hit a record high of US$2,790.15.

US gold futures shed 0.2 per cent to US$2,764.90.

US President Donald Trump said his administration was weighing imposing a 10 per cent tariff on goods imported from China on Feb 1. He also promised duties on European imports, without elaborating further.

He had earlier said Mexico and Canada could face levies of around 25 per cent by Feb 1.

Gold’s appeal as an inflation hedge may decline if Trump’s policies that analysts see as inflationary prompt the Federal Reserve to keep interest rates higher for longer, as bullion is a non-yielding asset.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The Fed is meeting next week against a backdrop of continued economic growth and declining inflation, but faces uncertainties from new administration policies.

The central bank is expected to hold its benchmark interest rate steady at its next policy meeting on Jan 28 to 29. Higher interest rates dampen the appeal of non-yielding gold.

European Central Bank policymakers lined up behind further interest rate cuts on Wednesday, indicating that next week’s reduction is all but a done deal and further moves will also come even if the Fed remains cautious.

According to Reuters technical analyst Wang Tao, gold might have to face resistance at US$2,759, which could trigger a correction.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.26 per cent to 869.36 tonnes on Wednesday from 871.66 tonnes on Tuesday.

Spot silver was flat at US$30.78 per ounce, palladium gained 0.1 per cent to US$978.85 and platinum steadied at 945.90. REUTERS