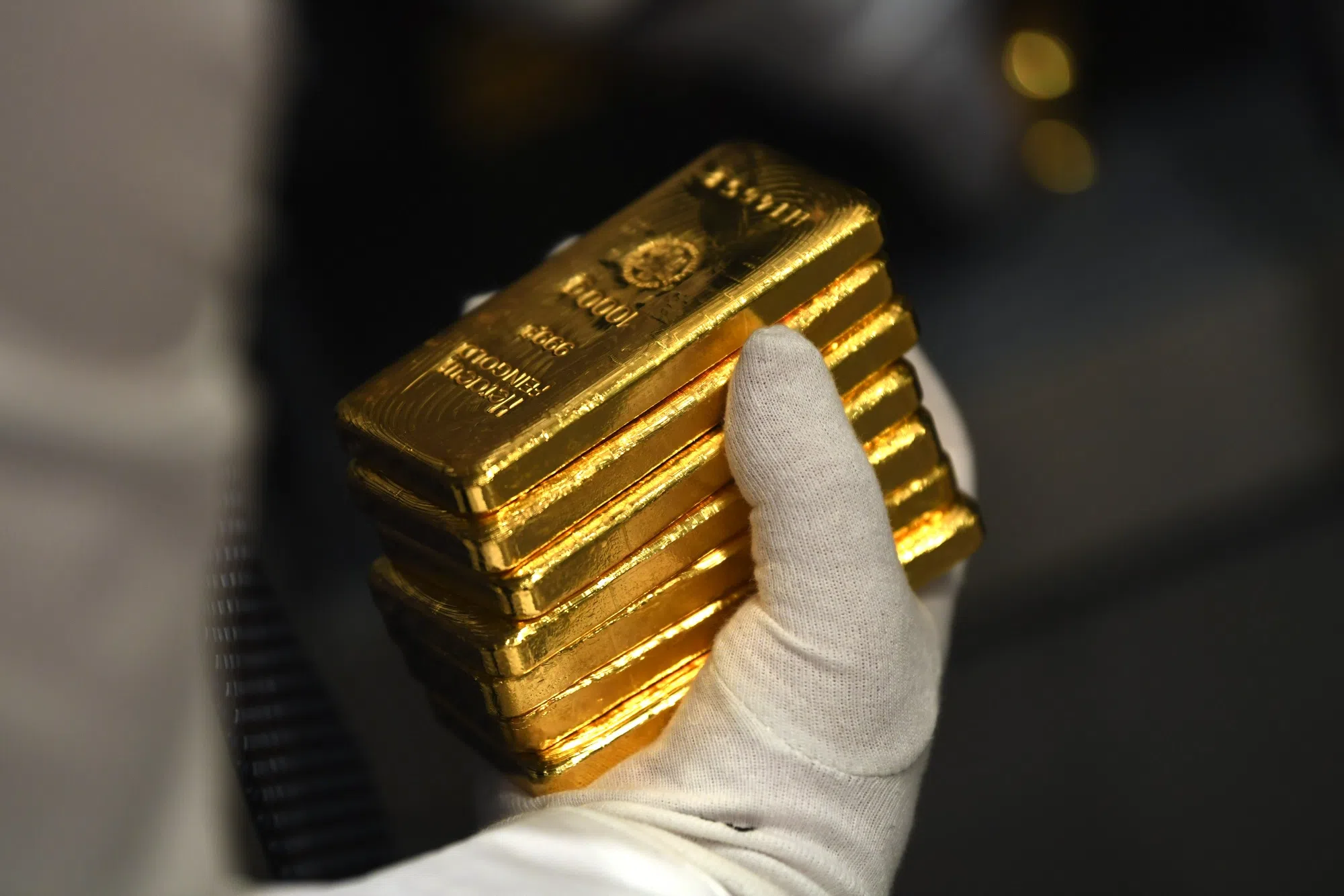

GOLD prices held steady on Wednesday (Sep 18) as market participants braced for an expected Federal Reserve move to cut interest rates for the first time in more than four years.

Spot gold edged 0.1 per cent higher to US$2,572.11 per ounce by 0018 GMT. Bullion rose to a record high of US$2,589.59 on Monday.

US gold futures rose 0.2 per cent to US$2,598.30.

Data released on Tuesday showed that US retail sales unexpectedly rose 0.1 per cent in August, suggesting that the economy remained on solid footing through much of the third quarter.

The Fed will deliver its interest rate decision at the conclusion of its meeting later in the day, with chair Jerome Powell holding a press conference afterward. The last Fed rate cut was in March 2020 during the Covid-19 pandemic.

Markets are currently pricing in a 64 per cent probability of a 50 basis point (bp) easing at the conclusion of the two-day meeting, against 43 per cent on Friday. The odds for a 25 bp rate cut have narrowed sharply after reports revived the prospect of a more aggressive easing.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

However, most economists expect the US central bank to cut rates by 25 bps on Wednesday, according to a Reuters poll, arguing that the economy is not in distress to warrant the half-percentage-point reduction being anticipated by financial markets.

Zero-yield bullion tends to be a preferred investment in a lower interest rate environment and during geopolitical turmoil.

On the geopolitical front, militant group Hezbollah promised to strike back at Israel after accusing it of setting off explosions across Lebanon on Tuesday, killing nine people and wounding nearly 3,000 others who included fighters and Iran’s envoy to Beirut.

Spot silver edged lower by 0.1 per cent to US$30.69 per ounce, platinum rose 0.1 per cent to US$982.79 and palladium was flat at US$1,115.69. REUTERS