Pickup indicates recovery in activity in the third quarter after a slow first half.

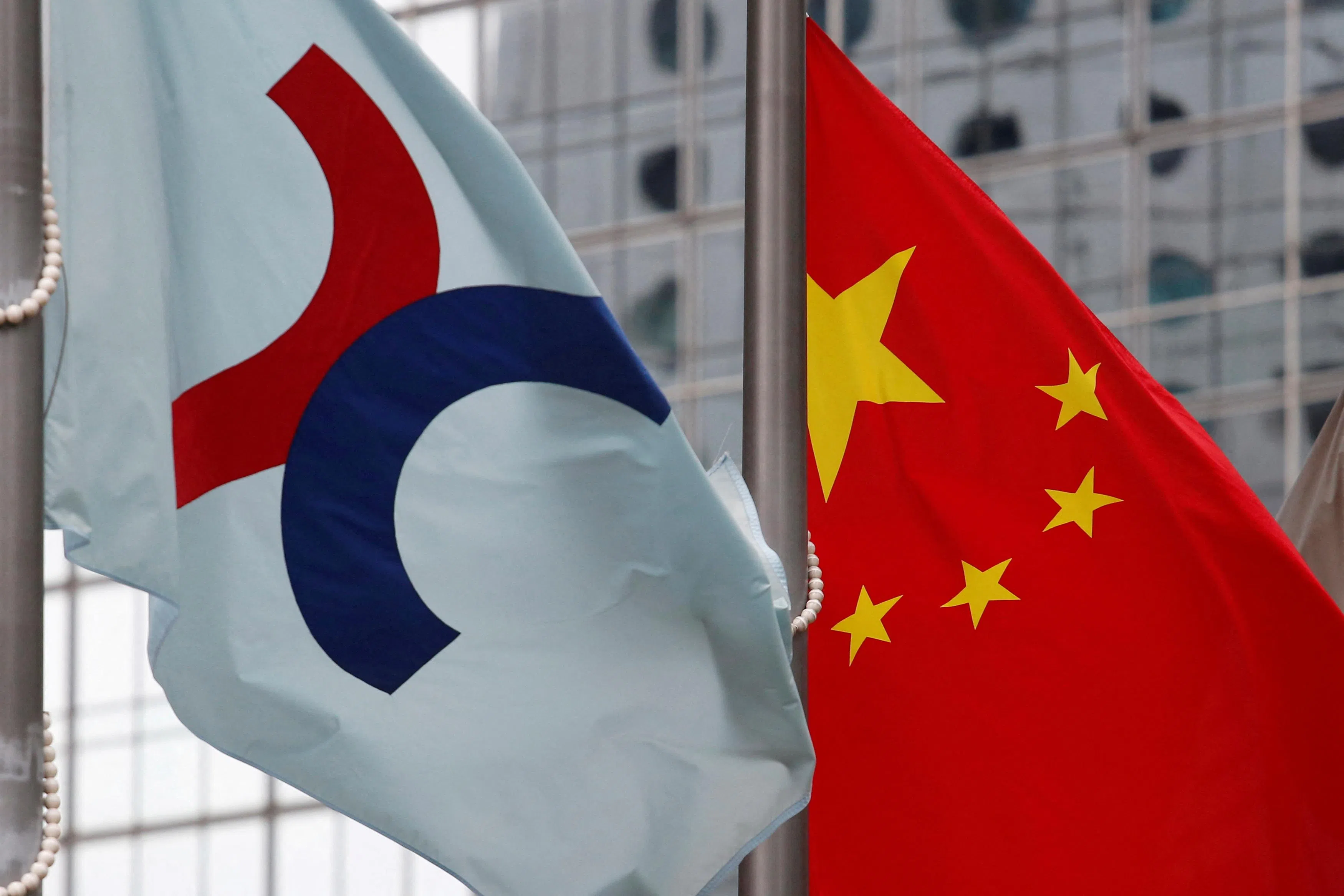

SIX companies are set to start trading in Hong Kong this week after raising a combined HK$4.31 billion (S$744 million) in the busiest week this year for IPO debuts.

The pickup in listings indicates a recovery in activity in the third quarter after a slow first half. Chinese authorities said earlier this year that they’d support industry leaders going public in the city after offerings slumped to the lowest level in two decades in 2023.

The six debuts make it the busiest week in Hong Kong since Dec 18, when seven companies started trading in the financial hub, according to data compiled by Bloomberg. The average size of each IPO in the city this year has dropped to HK$409 million from HK$616 million in the same period of 2023, the data show.

“There is no shortage of companies looking to list and regulators are forthcoming with approvals,” said Sharnie Wong, a Bloomberg Intelligence senior analyst. “But companies may be waiting for the right timing on valuation and market sentiment.”

The largest company due to start trading on Hong Kong’s exchange this week is aircraft manufacturer Cirrus Aircraft with an IPO that’s expected to raise about HK$1.5 billion. The company produces two aircraft product lines that are certified in 60 countries, according to the offering’s prospectus.

The second-biggest newcomer is Chenqi Technology, a Guangzhou, China-based ride-hailing services firm. The company is backed by China’s Tencent Holdings and Guangzhou Automobile Group, the Chinese state-backed carmaker.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Chenqi Technology ranked second in market share last year in China’s Greater Bay Area covering Hong Kong, Guangdong and Macau, according to the IPO’s prospectus. BLOOMBERG