Reuters

First Republic Bank became the epicenter of the U.S. regional banking crisis after the wealthy clients it courted to fuel its breakneck growth started withdrawing deposits and left the bank reeling.

Wall Street’s top banks, led by JPMorgan Chase & Co, have been trying for more than a week to raise capital for San Francisco-based First Republic after giving it $30 billion in deposits following the failures of regional lenders Silicon Valley Bank and Signature Bank.

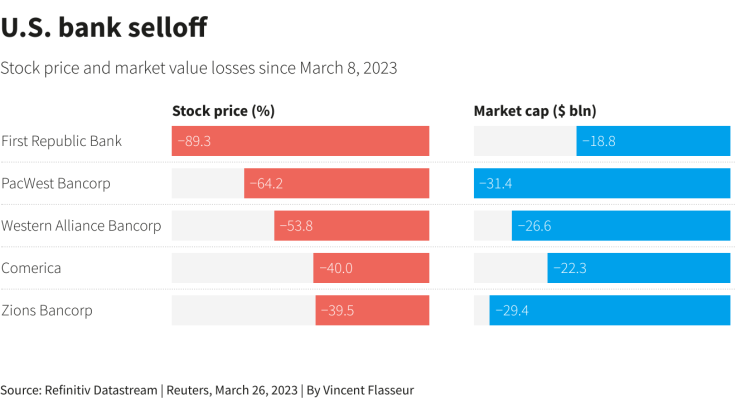

Despite their efforts, First Republic shares have swooned 90% in March, and banking analysts and industry experts say the bank is constrained in how it can revive its fortunes.

GRAPHIC: U.S. bank selloff-

For years, First Republic lured high net-worth customers with preferential rates on mortgages and loans. This strategy also made it more vulnerable than regional lenders with less-affluent customers, since U.S. deposit insurance only guarantees $250,000 per savings account. Morgan Stanley analysts estimated a deposit outflow of nearly half of total deposits according to a March 20 note. The bank had a high level of uninsured deposits amounting to 68% of assets.

First Republic’s loan book and investment portfolio also became less valuable as interest rates rose, which is hampering a capital raise. Analysts and investors pegged paper losses at between $9.4 billion and $13.5 billion.

“You’re not going to be able to realize nearly the same levels of growth,” said David Smith, a bank analyst at Autonomous Research.

A First Republic spokesperson said its bankers and wealth managers were still opening accounts, making loans and executing transactions with support from clients and communities.

“Our commitment to exceptional client service is unchanged, and we remain well-positioned to manage short-term deposit activity,” the spokesperson said.

In an investor presentation in January, First Republic boasted of shareholder returns compounding at 19.5% annually, more than double its peers. It outlined its strategy of pursuing wealthy customers and stated its median single-family home loan borrower had access to cash of $685,000, significantly more than the average American.

The bank was open about attracting rich clients using preferential rates for loans.

“To get to our best relationship pricing, we want the full deposit relationship,” First Republic executive Robert Lee Thornton told investors on Nov. 9. “It’s a very key focus and one of the reasons we’ve been able to grow deposit balances so quickly.”

In February, First Republic loaned $10 million over 30 years to the buyer of a condominium in Manhattan at an initial rate of 4.6%, according to New York City records. That compares to 5.5% currently offered by Bank of America for jumbo mortgages in the same zip code, according to that bank’s website. It is also one to two percentage points below the national average for 30-year jumbo mortgages last month, according to data from the Federal Reserve Bank of St. Louis.

BANKING THE SUPER RICH

Founded in 1985 by James “Jim” Herbert, son of a community banker in Ohio, First Republic focused early on providing big loans at cheap rates. Merrill Lynch acquired the bank in 2007 but First Republic was listed in the stock market again in 2010 after being sold by Merrill’s new owner, Bank of America.

Facebook founder Mark Zuckerberg obtained a First Republic 30-year mortgage of $5.95 million on a Palo Alto, California home at an interest rate starting at 1.05%, according to a 2012 Bloomberg article.

Other customers have included Instacart founder Apoorva Mehta, investor Chamath Palihapitiya and real estate developer Stephen M. Ross, according to bank promotional materials.

A spokesman for Ross’ Related Companies said he remains committed to First Republic. Representatives for Zuckerberg, Mehta and Palihapitiya did not respond to requests for comment.

Randy Randleman, co-founder of Sumeru Equity Partners, told Reuters he used the bank’s competitive rates for lines of credit for his San Mateo, California-based private equity firm to invest in growing technology companies, and to make loans to employees so they could invest in Sumeru’s funds.

“They provide a very high level of service to firms like ours,” Randleman said, adding he remains a loyal client.

First Republic also caters to less-wealthy members of the community, according to bank materials which note that schools and non-profits account for 22% of its business loans.

INTEREST RATES RISE

First Republic started amassing paper losses last year when the Federal Reserve began hiking U.S. interest rates rapidly to fight inflation while the bank was still trying to beat rivals on pricing.

Gross unrealized losses in held-to-maturity investment portfolio, mainly government-backed debt, ballooned to $4.8 billion at the end of December from just $53 million a year earlier, according to First Republic’s annual report.

Absent government intervention or lower U.S. interest rates, such losses would have to be realized by an acquirer taking over First Republic, or the bank selling debt to boost liquidity.

First Republic’s annual report also warned investors that more than half its loan book was comprised of single-family residential mortgage loans, especially jumbo loans, that are difficult to offload.

Patricia A. McCoy, a professor at Boston College Law School and former Treasury Department official, said First Republic would find it hard to overcome the challenges of resurrecting its old business model and regaining confidence of depositors who fled.

“Wealthy customers were drawn to First Republic in part because they could get large mortgages at rock-bottom interest rates,” said McCoy. Now that rates are much higher, those bargain mortgages are worth far less to potential buyers. “That is putting a lot of strain on banks.”