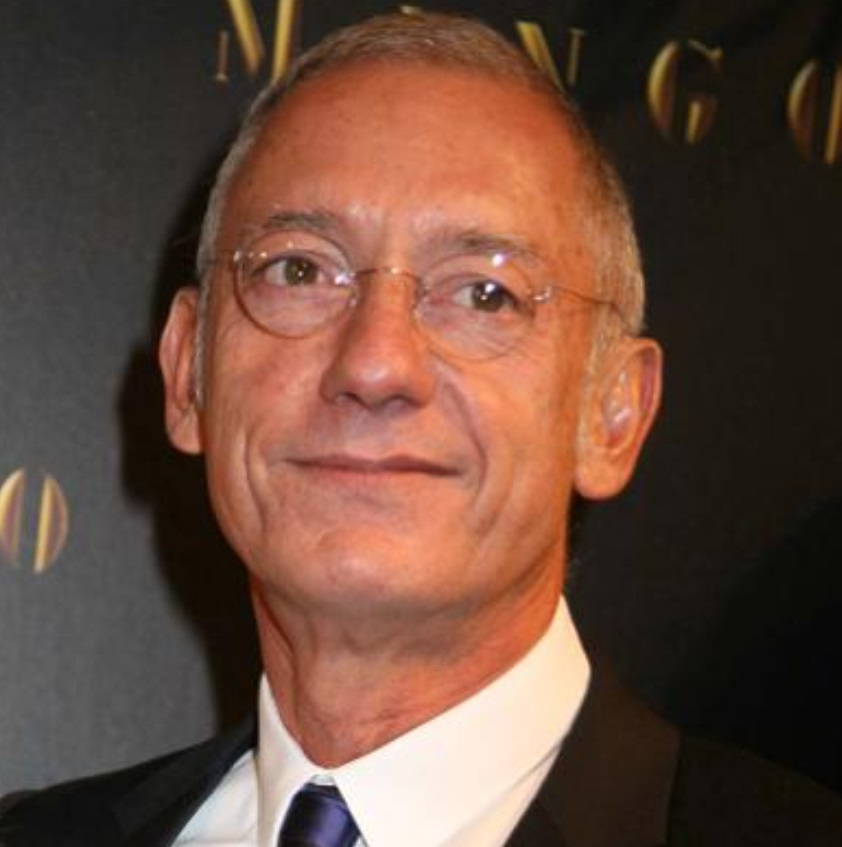

OUTGOING DBS chief executive Piyush Gupta would have done things differently if he were given another chance to build the bank’s technology capabilities.

Gupta’s 15-year tenure as head honcho saw DBS go all in to develop tech systems that transformed much of the bank ’s operations.

DBS, South-east Asia’s largest bank, started its digital transformation in 2014, the same year it launched its PayLah! mobile wallet, that has since found a home in the smartphones of many customers. This was followed by other milestones, such as eliminating physical tokens for corporate transactions.

But the bank has also had several disruptions in recent years, including a two-day outage to its digital banking services in November 2021.

Those seemed uppermost in Gupta’s mind when he told the Singapore FinTech Festival on Nov 7 that in regard to digital capabilities: “I did not actually think enough, and hard enough, about the operational complexity that comes with a distributed microservice architecture”.

In microservices, software is composed of independent units that communicate with one another.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“So how do you actually focus and dial up a lot more on resiliency while you’re pushing the innovation and speed agenda? I would do it differently, if I were to do it again,” he said in a dialogue with Monetary Authority of Singapore chief fintech officer Sopnendu Mohanty.

Setbacks are necessary for progress, though, as Gupta knows all too well. Before joining DBS, he spent 27 years at Citi, except for a one-year stint as a tech entrepreneur in 2000 when the internet was taking off.

When the dot.com bubble burst, Gupta had to pull the plug on his venture and subsequently found himself feeling lost.

“I left a very thriving, flourishing career. Apart from the loss of face, there was also a loss of self-confidence… I decided to come back to banking and as I evaluated my career at the time, it seemed that I had lost at least two or three years in my career from taking this divergence,” said Gupta, 64, who previously described the acute anxiety he experienced when his business failed.

“It wasn’t easy. It took me some time to get back into the swing and rhythm of things,” he said.

In hindsight, the business failure was a defining moment, added Gupta, who will retire in March 2025 with veteran banker Tan Su Shan stepping into the role.

“It increased my appetite to take risks. Once you see the bottom of the barrel, you think, how much worse can it get? And you’re willing to step up,” he said.

The second change came in the form of shifting priorities.

“Like a lot of young people, my whole ambition was driven by career success. How do I get promoted? How do I become managing director? How do I move on the fast track?

“When I came back to banking, it was with the singular realisation that I enjoyed banking, that I thought I was good at it. For the first time, I consciously thought about the idea of impact and that (banking) was an area where I could make a difference.”

Over the years, Gupta has also realised the truth in the saying “culture eats strategy for breakfast”, adding: “If you can create a culture of entrepreneurship and risk-taking, then it’s like magic.”

Gupta recalled how he was initially dead set against PayLah! as he thought a mobile wallet was “superfluous” in a world where people can debit funds directly from their bank accounts.

But his staff persuaded him, and PayLah! now has nearly three million users, offering not only payments but also deals and rewards.

When Mohanty asked how he will manage the transition to retirement, Gupta pointed to his passion for nature and wildlife, as well as education.

He is chairman of both Singapore Management University and Mandai Park Holdings – the holding company of Mandai Wildlife Group, which operates Bird Paradise, Night Safari, River Wonders and Singapore Zoo.

Gupta, who enjoys bird-watching, said: “When you get to my stage of life, the biggest premium is time. I’ve done over 40 years of banking and finance… I want to make sure I leave space for the other things in my life, so I don’t look back with regret.” THE STRAITS TIMES