VENTURE Global raised US$1.75 billion in its initial public offering (IPO), pricing its shares in the middle of a marketed range.

The Arlington, Virginia-based company sold 70 million shares for US$25 each, according to a statement.

The pricing gives the company a market value of US$60.5 billion, based on the number of outstanding shares listed in an earlier filing, well below its original target of US$110 billion. Including employee stock options, the company has a fully diluted value of more than US$65 billion.

Venture Global on Wednesday (Jan 22) slashed the price range for the IPO by more than 40 per cent and increased the number of shares offered, after investors approached during the marketing wanted a lower range, Bloomberg News reported.

The nearly US$50 billion difference between the liquefied natural gas (LNG) exporter’s original valuation target and the actual figure is one of the largest drops in percentage terms on record for a sizeable IPO. Still, at that price, Venture Global’s offering is the largest energy-sector IPO in the US since Shoals Technologies Group raised US$2.2 billion in 2021, data compiled by Bloomberg show.

Venture Global had offered 70 million shares for US$23 to US$27 each, after having earlier marketed 50 million shares for US$40 to US$46 each, its filings show.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The listing nonetheless adds to the growing momentum in the US IPO market. First-time share sales raised nearly US$43 billion last year, a 64 per cent increase on 2023’s volume yet still below the average in the decade before the pandemic, data compiled by Bloomberg show.

Venture Global had a net income of US$756 million in the nine months ended Sep 30 on revenue of US$3.4 billion, versus a net income of US$3.6 billion on revenue of US$6.3 billion in the same period in 2023, according to the filing.

The IPO intensifies the spotlight on Venture Global’s founders, Mike Sabel, 57, and Bob Pender, 71, who were initially viewed as outsiders to the established energy industry.

Chief executive officer Sabel’s base salary was US$7.5 million in 2024, according to the S-1 filing, while Pender was paid US$3.5 million.

In 2023, Sabel and Pender each were awarded bonuses of US$26 million. The filing also disclosed US$2.7 million spent in personal security for Sabel’s residences.

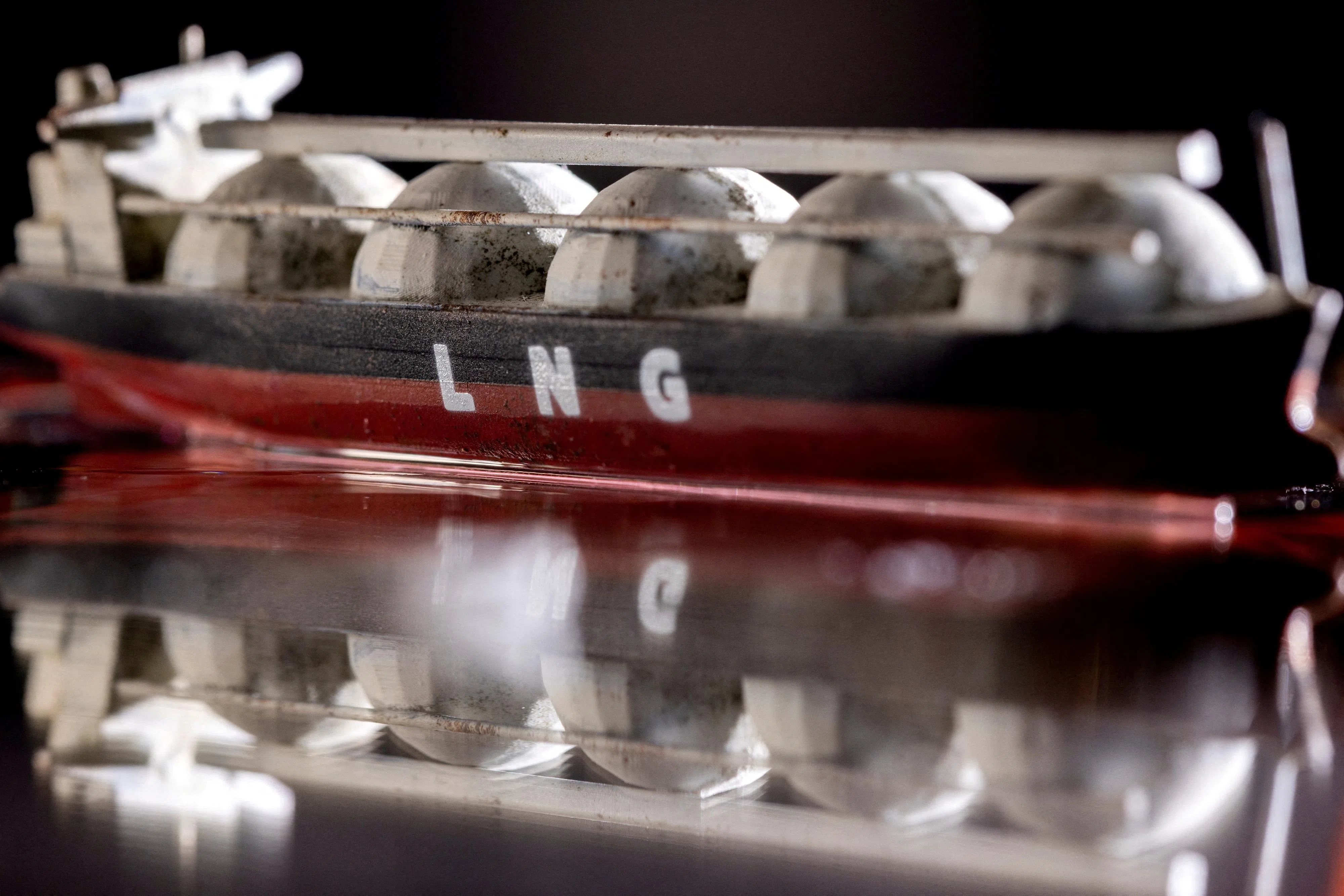

LNG is expected to play an increasingly central role in global energy markets in the years ahead, as nations seek a cleaner-burning alternative to oil and coal. The US’s position as the world’s largest supplier of the fuel is poised to grow even stronger, with President Donald Trump directing his Energy Department to resume reviewing applications for LNG export terminals. The move reverses a moratorium Joe Biden ordered that disrupted plans for multi-billion dollar export projects by Venture Global and others.

The company has been exporting gas from its Calcasieu Pass facility in Louisiana since 2022 and sent its first shipment from Plaquemines LNG, located outside New Orleans, in December. With Plaquemines fully operational, Venture Global is set to become the second-largest LNG producer in the US, behind Cheniere Energy Inc.

Venture Global is attempting to build a more integrated supply chain than some of its peers. It has secured capacity at facilities in the UK and Greece, where its LNG would be re-gasified and sent to end users, a strategy that would allow the company to win greater market share, according to its filings.

Pending arbitration claims against Venture Global in cases by eight separate companies, including some oil majors, total as much as US$5.9 billion, Bloomberg News has reported. The claims allege the company has not delivered gas to customers at Calcasieu Pass that signed up for long-term contracts. A Venture Global spokesperson said the cases have no contractual or other basis.

The company’s Class A shares will offer investors one vote per share, while Pender and Sabel will retain control of the company with Class B shares, which offer 10 votes each, the filings show.

The offering is being led by Goldman Sachs, JPMorgan Chase and Bank of America. The company’s shares are set to begin trading Friday on the New York Stock Exchange under the symbol VG. BLOOMBERG