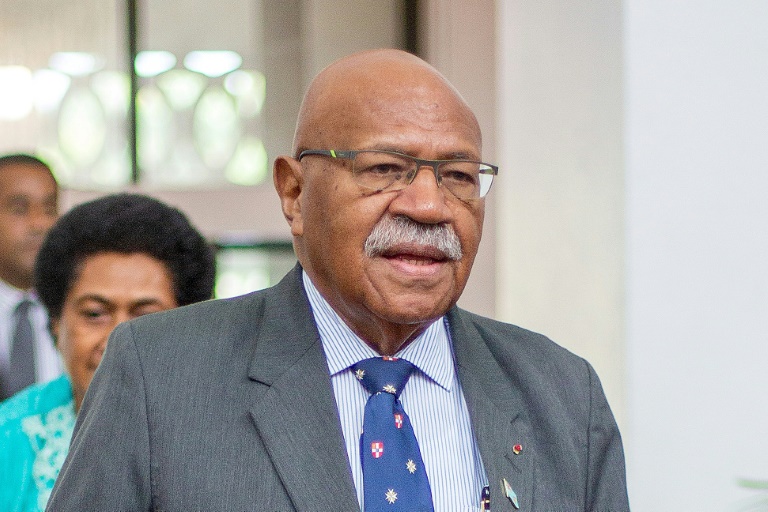

Mohammed AlKaff AlHashmi

Mohammed AlKaff AlHashmi, a graduate of the University Of Aden, is an entrepreneur with a series of cutting-edge tech initiatives that are considered to bring value to the MENA region’s communities. Mohammed AlKaff is the co-founder of Islamic Coin, a native currency of Haqq community-run blockchain, dedicated to empowering an ethics-first Shariah-compliant financial ecosystem. It aims to bring direct economic value to the Muslim community by offering new-age halal financial tools and solving the problem of the unbanked Muslim people.

Q: What is Haqq Blockchain? How is it different from existing digital finance initiatives?

Haqq Blockchain is a Shariah-compliant, ethics-first blockchain. Its primary purpose is to help the Islamic community make their day-to-day online monetary transactions ethical. In addition to all other features other chains provide, it uses POS, which is more eco-friendly. Haqq is also Ethereum-compatible.

Haqq supports innovation and philanthropy along the way: 10% of every minted coin goes to the EverGreen DAO Endowment Fund, established to help non-commercial, community-oriented initiatives.

Q: Why do you think empowering the world’s Muslim community and beyond with a financial instrument for the Digital Age is important?

The Muslim community is currently about $1.8 billion, $1.1 billion of which are active internet users. Halal finance is estimated to have a $3 trillion market cap and is expected to grow to 3.7 trillion by the end of 2023, in addition to the 3+ trillion halal products market.

A community of this size should be supported with necessary FinTech instruments and tools.

Q: What are the ESG requirements and ethical rules that shape your attitude toward the business, if any? How do any of these influence your 2023 plans for Islamic Coin?

Inflation rates are reaching their highest numbers in the past 40 years; the environment is crying from emissions and climate change, so we are focusing on spreading more awareness, increasing the ethics-first sustainable economy, and supporting environmentally friendly projects.

Our rule is to never back projects with a negative impact on the community, such as gambling or unbalanced deals. It’s our vector for 2023 and beyond.

Q: In your opinion, what is the most important problem of the Middle East finance sector? What are your plans for solving one? What would your very next aim be like?

We live in an era where most of the world’s population is suffering financially and environmentally. The reason for that is the gap between financial ethics and values – in addition to the inflation challenges that loans with interest charges. Shariah finance can be a solution here, and we are working to empower it with FinTech tools.

Soon, we will launch our own mobile wallet that unbanked people can use for daily transactions and payments without being crypto experts. They can always use islamicCoin as a store of value: it’s more accessible, Shariah-compliant, safe, and fast.

We are also planning to introduce a halal Shariah-compliant exchange, Stable Coin.

Q: Just recently, your project joined the UN Climate Change Conference. Did anything you’ve heard there influence your attitude to Islamic Coin’s roadmap for 2023? Do you think your project can solve any of the existing ecological problems?

There is common ground among climate change, sustainable economy, and technology, where our project plays an important role. We aim to drive community awareness and investments towards eco-friendly projects, and, of course, EverGreen DAO will focus more on supporting projects to overcome the climate change challenges.

Q: Do you plan to roll your coin on global exchanges in 2023 or make it accessible in any other way?

We plan to get listed on major global exchanges in 2023. In the meantime, we will encourage the community to use the upcoming Islamic Coin wallet that will be Master Card-enabled.

Q: Do you think Muslims entering digital finance can change the global financial industry?

Yes, by creating the Shariah Finance ethics tool that is easy to use in daily life. More and more financial institutions introduce shariah-compliant products, and IslamicCoin has received more than USD 200 million in investments during four weeks of private sales starting. There is, obviously, a huge market for such a FinTech instrument.