Nvidia CEO Jensen Huang shed a record amount of shares from his portfolio last month, ahead of a brutal global stock sell-off. According to Securities and Exchange Commission filings, Huang sold $322.7 million worth of Nvidia shares in July, contributing to the nearly $500 million he has offloaded this summer.

The transactions were part of a pre-determined trading plan that Huang filed in March, which proved to be well-timed, according to Business Insider.

The reasons for his sales were not detailed in the filings, but such transactions are often routine for executives managing personal investment portfolios. His sales preempted a broader tech stock downturn that intensified following disappointing economic data and underwhelming tech earnings reported last Thursday.

Nvidia’s stock has faced pressure even before the latest market volatility, with investors increasingly concerned about the effects of substantial spending on artificial intelligence on corporate profits.

The company’s stock fell an additional 7% on Monday, culminating in a roughly 20% decline over the past month.

Huang’s stock sales are part of a broader trend within Nvidia, where company insiders have collectively sold more than $1 billion worth of shares this year, as reported by Bloomberg.

Since 2020, Huang has sold $1.4 billion in Nvidia stock and plans to continue his stock sales through August, according to another filing. Despite the sales, SEC documents show that Huang still retains a significant number of Nvidia shares.

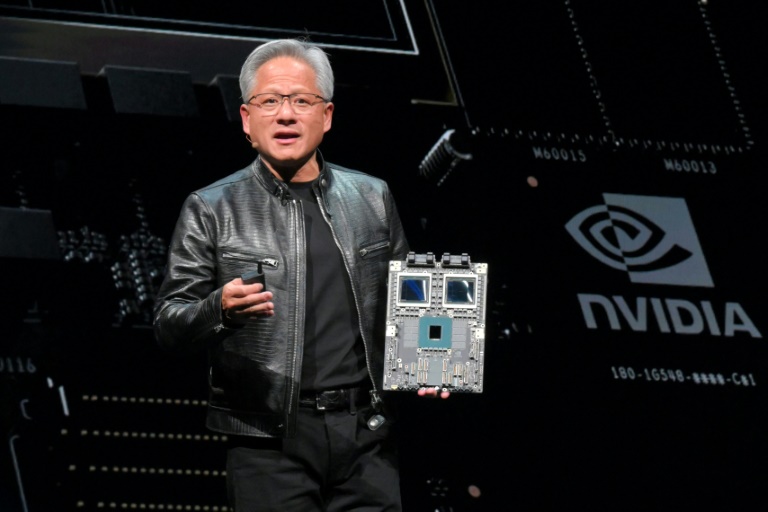

Nvidia, a leader in the semiconductor industry known for its graphics processing units and system-on-chip units for various markets, has seen its market capitalization decline alongside a broader tech stock downturn.

Investor concerns over high valuations and disappointing quarterly earnings contributed to this trend, reducing Nvidia’s market cap by 5.2% to $2.8 trillion in July.

According to InvestingPro data, Nvidia’s market capitalization remains strong at $2.62 trillion. The company’s revenue growth over the past 12 months, an impressive 208.27%, also reflects robust business expansion.

In June, Nvidia unveiled its ambitious plan to launch its most advanced artificial intelligence platform by 2026. The upcoming platform will feature next-generation memory technology designed to enhance processing times.

Around the same time, Foxconn revealed its plan to construct an advanced computing center in Taiwan, utilizing Nvidia’s cutting-edge Blackwell chips. This partnership marks a significant step as Nvidia and Foxconn collaborate to build data centers aimed at advancing autonomous driving and the electric vehicle market.

Tesla, currently a user of Nvidia’s chips, has also announced plans to develop its custom chips in the future.