Republicans are gearing up efforts to pass an extension for Trump tax cuts through the reconciliation process in the event that they become overwhelmingly victorious in November’s election.

The Tax Cuts and Jobs Act (TCJA) was passed by the GOP using the budget reconciliation maneuver almost seven years ago. Now, the party is already making plans to once more use reconciliation to renew provisions that are set to expire in 2026.

What makes the budget reconciliation the most viable option for the GOP is that lawmakers could pass tax and spending bills using only a simple majority, as opposed to the usual needed support of 60 senators to pass bills. In addition, budget reconciliation does not need bipartisan backing, hence, the party with the numbers can readily pass such legislation.

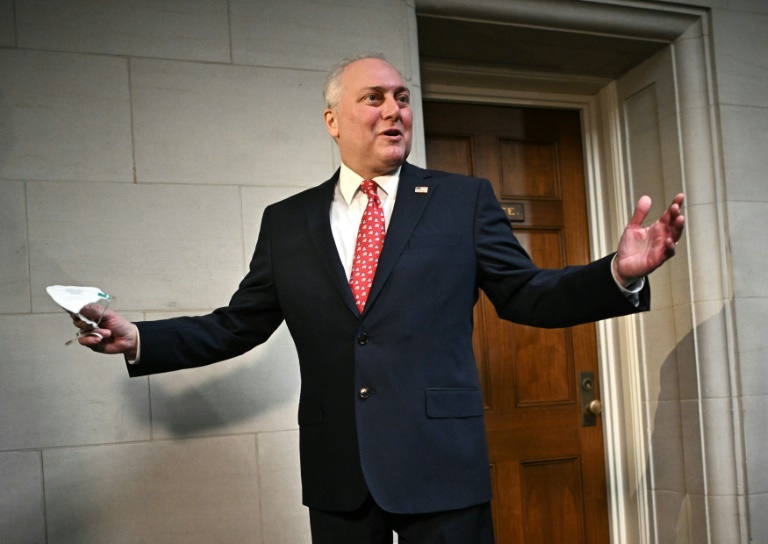

House Majority Leader Steve Scalise (R-La.), just last week discussed reconciliation with his conference, galvanizing members about the process, which could possibly bring one of the group’s top policies to fruition, reported The Hill.

“With Leader Scalise, it was really a process of reminding everybody of the importance of reconciliation, how that was used in 2017, how the Democrats used that during the first two years of the Biden term,” said David Kustoff (R-Tenn.), who was a member of the Ways and Means Committee.

Republicans are not the only party using budget reconciliation to pass bills. Two of the notable pieces of legislation that were passed by Democrats using reconciliation include the Affordable Care Act under former President Barack Obama, and the Inflation Reduction Act under Biden.

“We need to be prepared with different options. It cannot be overstated that it’s important to plan ahead, policy-wise. We worked on TCJA for years before we had unified government,” said Rep. Adrian Smith (R-NB).

Republicans are also noting who would be deciding the extent of the bill that can be passed through the limited reconcilation process.

“We always have to be mindful of the pretty restrictive rules that surround reconciliation. You can’t get too creative or you get outside the boundaries of what’s allowed under the Senate rules,” Rep. Doug Lamborn (R-Colo.) stated.

A recent report by the nonpartisan Congressional Budget Office (CBO) showed that extending Trump tax cuts for 10 years would be adding $4.6 trillion to the deficit. It also pointed out that the tax cuts mainly benefit large corporations and those of America’s wealthiest.

“Republicans are awfully eager to shield their megadonors from paying taxes,” said Budget Chairman Sheldon Whitehouse.