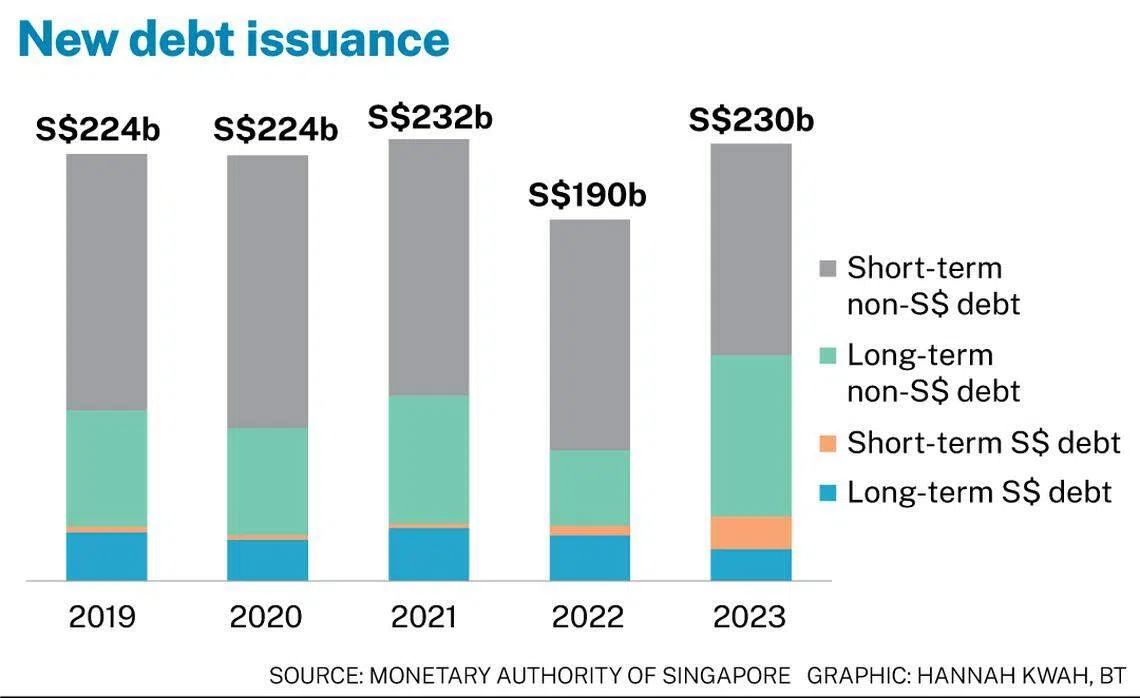

SINGAPORE’s financial sector had a good showing in 2023 with a 10 per cent growth in assets under management (AUM) to S$5.41 trillion as at Dec 31, 2023, while the corporate debt market also grew strongly, with new issuances rising 21 per cent to S$230 billion.

Private markets have also grown strongly over the years.

Singapore’s financial sector remained resilient in 2023, with good progress across the board, said Chia Der Jiun, managing director of the Monetary Authority of Singapore (MAS) on Thursday (Jul 18).

AUM growth in the Singapore asset management industry was in line with the 10 per cent compounded annual growth rate (CAGR) over the past five years.

Notably, private markets grew significantly over the years, Chia said. Singapore’s private equity and venture capital AUM grew at a CAGR of 24.6 per cent to more than S$650 billion from 2018 to 2023.

Over half of these assets were directed towards supporting the growth of businesses in the Asia-Pacific region.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Chia expects private credit to continue to grow, as large global private credit managers expand their Asia teams in Singapore, and new private credit managers establish presence here to tap investment opportunities in the region.

In the Singapore Asset Management Survey 2023 also released on Thursday, MAS noted that Singapore’s growth is faster than the AUM growth in Asia of 8 per cent. Global AUM growth stood at 12 per cent, on the back of gains in global bonds and equities after a challenging 2022.

Singapore is a key gateway for global asset managers and investors to tap the region’s growth opportunities, with 77 per cent of AUM sourced from outside Singapore, and 89 per cent of total AUM invested outside the country.

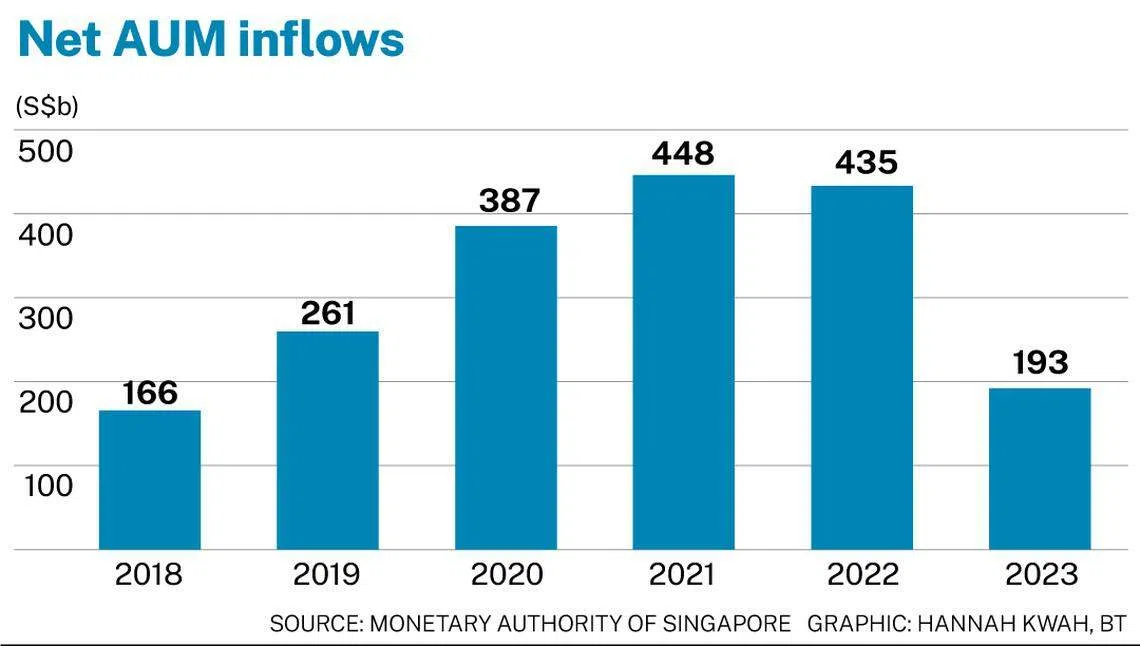

Yet, net AUM inflows fell in 2023 to S$193 billion, the lowest since 2018. MAS said this reflects the challenges faced by asset managers in raising funds and managing monies, amid continued market volatility in public markets and investors’ caution.

Meanwhile, Singapore’s corporate debt market also rebounded strongly amid increased financing needs from global corporates to fund business expansion despite high interest rates.

The outstanding size of the market registered a 10.5 per cent increase to S$566 billion.

The insurance sector also continued to grow in 2023, with net premiums increasing by 6.4 per cent and total assets for the overall insurance sector up by 6.8 per cent.

Improving FIs’ resilience service delivery

MAS plans to further sharpen financial institutions’ (FI) focus on resilience of service delivery.

It will consult on enhancing the requirements set out in its notice on technology risk management, with the intention for FIs to take a service-centric, and not just a system-centric, recovery time objective.

FIs also need to identify and address single points of failure in critical business services; and fully test their recovery plans through an annual exercise to ensure that they are able to operate from their disaster recovery site for a prescribed minimum time period.

MAS will also consult on instituting a technology assurance programme for financial institutions that are core to Singapore’s financial system.

Chia also noted that financial services have achieved a high level of digitalisation in recent years. Almost all Singaporean adults have registered for PayNow, which had a total transaction value of S$94 billion in 2023.

Almost all merchants have also registered for Singapore Quick Response Code (SGQR) payment, with 300,000 SGQR payments acceptance points for consumers to make payments.

Central bank operations

For the financial year ended Mar 31, 2024, MAS recorded a net profit of S$3.8 billion, reversing a net loss of S$30.8 billion as global bond and stock markets recovered.

Currency translation effects were positive and amounted to S$1.7 billion, due primarily to a weakening of the Singapore dollar against the US dollar, euro and pound sterling.

Singapore’s monetary policies are centred upon managing the single exchange rate of the Singapore dollar against a trade weighted basket of currencies.

Thus, when the Singapore dollar weakens against the foreign currencies that maintain MAS’ official foreign reserves (OFR), the central bank experiences a positive currency translation effect.

MAS held S$497.6 billion (US$368.7 billion) of OFR as at Mar, 31 2024.

The central bank also recorded an investment gain of S$12.7 billion in FY2023/24.

Global markets generally rebounded, particularly in the second half of the financial year, amid resilient global growth and moderating inflation.

The investment gain was mainly from interest income, dividends and realised gains from the management of OFR, offset by valuation provisions.

Compared to the previous financial year, all major asset classes including developed markets and emerging markets bonds and equities posted higher returns.

Overall, MAS recorded total investment gains, including currency translation effect, of S$14.4 billion in FY2023/24.

MAS also incurred a net cost of S$9.2 billion for money market operations, after offsetting interest income from reserves management government securities.