THAILAND plans to sell as much as US$1.1 billion of baht-denominated sustainability-linked bonds (SLBs) in the fourth quarter, in what looks set to be the first such offering from an Asian government.

The sale will finance the government’s budget deficit, and is tied to programmes that are intended to reduce carbon emissions, Jindarat Viriyataveekul, public debt advisor at the finance ministry, said. The bonds will be offered to both local and foreign institutional investors, she said.

“The demand is quite good,” Jindarat said on Tuesday (May 28), citing the result of the office’s recent market survey. “Investors have shown strong interest in this green financing in line with a growing global trend.”

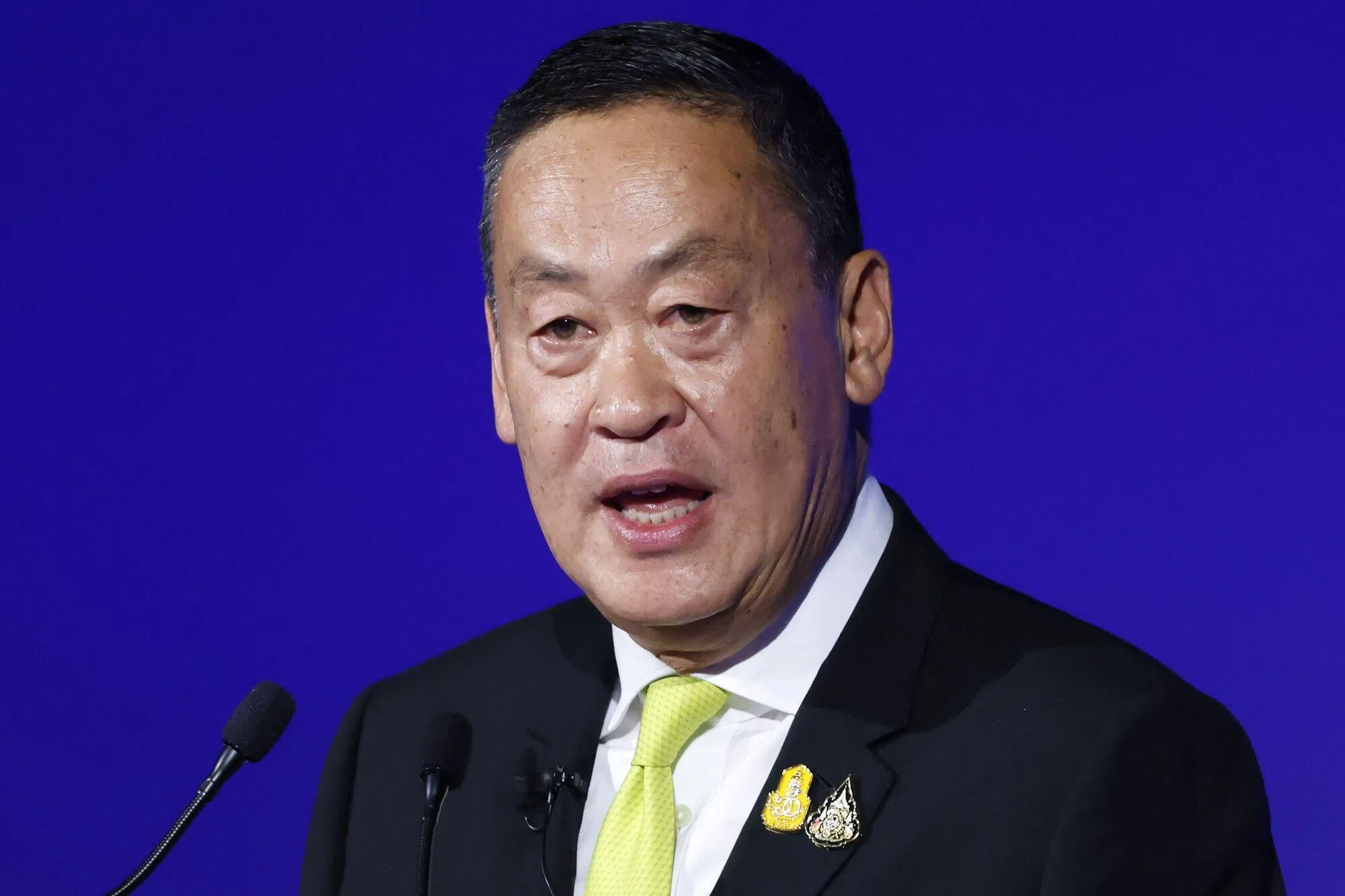

Prime Minister Srettha Thavisin is stepping up efforts to promote the nation’s focus on sustainability as a key selling point to attract foreign investors, with BlackRock and Intesa Sanpaolo among those showing interest in the baht SLB sale. The South-east Asian nation has pledged to achieve carbon neutrality by 2050.

The SLB issuance will take place before any government sale of foreign-currency bonds, which the ministry is still studying, Jindarat said. The weak baht and the Federal Reserve’s uncertain monetary policy path have made a plan to tap the overseas market less attractive, she said.

SLBs may replace sustainability bonds that the government has been offering in past years as there is more flexibility in how proceeds from the former can be used, Jindarat said. BLOOMBERG

A NEWSLETTER FOR YOU

Asean Business

Business insights centering on South-east Asia’s fast-growing economies.