An influential group of global and Indian investors like Tiger Global, DST Global, Peak XV Partners, Kalaari Capital, Matrix Partners India, and Kotak Private Equity have urged Prime Minister Narendra Modi to reconsider the decision to levy 28 per cent GST on online skill gaming.

The group of investors wrote a letter to PM Modi, saying the current GST proposal will set up the most “onerous tax regime” for the gaming sector globally, which will lead to “a potential write-off of the $2.5 billion capital invested in this sector”.

“This will also adversely impact prospective investments to the tune of at least $4 billion in the next 3-4 years and hence the growth of the gaming sector in India,” they wrote.

The 28 per cent GST on full value of online gaming has “caused shock and dismay” and will “substantially and meaningfully erode investor confidence in the backing of this or any other sunrise sector in the Indian tech ecosystem”, they lamented.

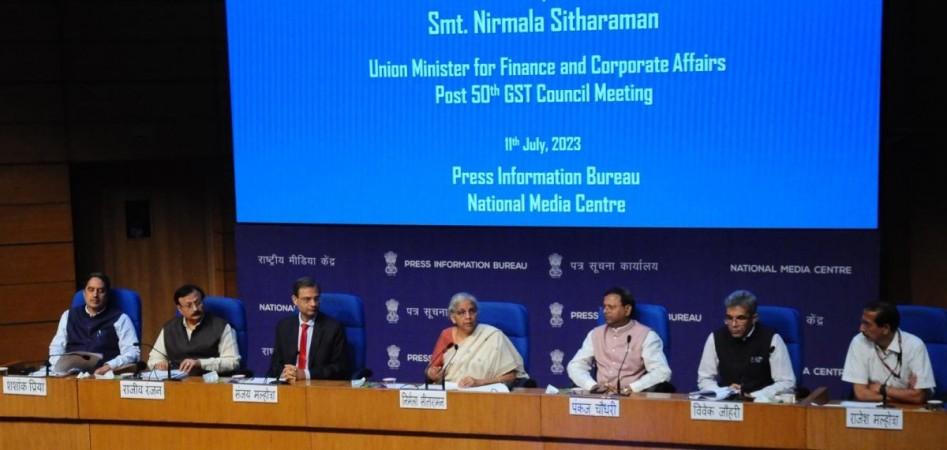

The decision of the 50th GST Council has the unintended consequence of equating the constitutionally protected legitimate online skill gaming industry with gambling, betting and other “games of chance”.

“We invested in this sector with the vision to make India the gaming capital of the world, which would help in generating, among other things, high-skilled jobs, billions in foreign capital and make the country a net exporter of innovation in gaming and allied areas such as animation, artificial intelligence and visual effects,” said the VCs.

Last weekend, 127 online gaming companies and organisations wrote an open letter to the government, urging it to reverse the 28 per cent GST on the full deposit value and segregate skill gaming from betting and gambling which has left the industry in significant distress.

The letter, which had participants like Baazi Games, Dangal Games, Gameskraft Technologies, Nazara Technologies, and WinZO Games Private Ltd, said this move would potentially have devastating implications (including shut down of businesses) for MSMEs and startups that may not have the capital reserves to withstand such a sharp tax increase.

(With inputs from IANS)

![Top investors urge PM Modi to reconsider 28% GST on online skill gaming [details]](https://data1.ibtimes.co.in/en/full/787258/online-gaming.jpg)