President Donald Trump appears ready to make a major change to how the American economy is run. Reports from Washington on Friday, 30 January 2026, suggest that the President is very close to nominating Kevin Warsh as the next Chair of the Federal Reserve.

This role is often called the most powerful economic job in the world, similar to the Governor of the Bank of England, but with influence over the entire global financial system.

A Familiar Face Returns to the Spotlight

For those who follow American finance, Kevin Warsh is a well-known name. The 55-year-old is not new to the world of central banking. He served on the Federal Reserve’s Board of Governors from 2006 to 2011. This means he was helping to steer the US economy during the Great Financial Crisis of 2008.

Prediction markets, where people place bets on future events, showed a sharp rise in support for Warsh on Thursday. While other names were on the shortlist—such as National Economic Council Director Kevin Hassett, Federal Reserve Governor Christopher Waller, and investment boss Rick Rieder—Warsh has emerged as the clear favourite.

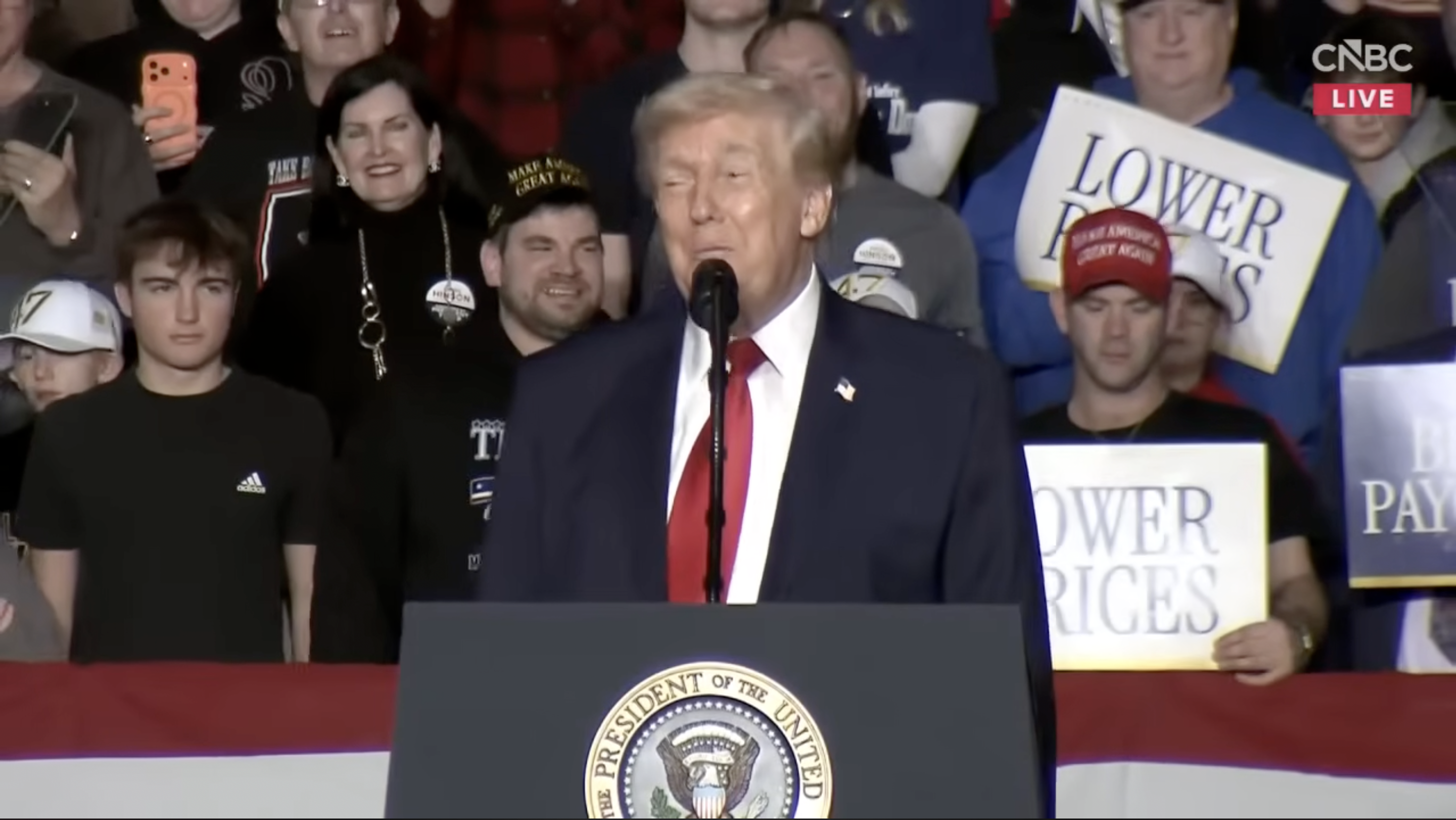

President Trump hinted at the news on Thursday evening. Although he did not say the name out loud, he told reporters that the choice would be someone very famous in the financial world. ‘A lot of people think this is somebody that could’ve been there a few years ago,’ Trump said. This was a clear nod to 2017, when Warsh was a top candidate for the job, but Trump decided to pick Jerome Powell instead.

Why Trump Seems to Prefer Warsh Now

The relationship between a President and the Federal Reserve Chair can be tricky. The Fed is supposed to be independent, meaning it makes decisions about money and interest rates without listening to politicians. However, President Trump has often said he wants a Chair who listens to his views.

In the past, Kevin Warsh was known as an ‘inflation hawk.’ In financial terms, a hawk is someone who prefers higher interest rates to keep prices from rising too fast. Trump, on the other hand, usually loves low interest rates because they make it cheaper for businesses to borrow money and grow.

However, in recent months, Warsh has changed his tune. He has publicly argued for lower interest rates, aligning himself perfectly with the President’s wishes. This shift seems to be the main reason he is now the top pick. By supporting cheaper borrowing costs, Warsh has shown he is on the same page as the White House.

Tension Over the ‘Balance Sheet’

Despite their agreement on interest rates, there is one area where Warsh and President Trump might disagree. Warsh has called for a ‘regime change’ at the central bank. He wants to reduce the size of the Fed’s ‘balance sheet.’

To explain simply, the Fed’s balance sheet is the amount of assets (like government bonds) the bank owns. A smaller balance sheet means the Fed would buy fewer bonds. This usually tightens the money supply, which is the opposite of the ‘loose’ money policy Trump generally likes. It remains to be seen how they will resolve this difference if Warsh gets the job.

What Happens Next?

If nominated, Kevin Warsh would replace the current Chair, Jerome Powell. Mr Powell’s term is set to end in May 2026. Powell has had a difficult relationship with Trump, who frequently criticised him for not lowering rates fast enough.

The nomination is not final until the US Senate votes to confirm him. However, with the President’s backing and his previous experience in the role, experts believe Warsh stands a very good chance. His appointment would signal a new direction for the American economy, moving away from the policies of the last four years.

Originally published on IBTimes UK