Its new group CEO Tan Teck Long must balance what minority shareholders want with the interests of one of Asia’s wealthiest clans

[SINGAPORE] OCBC’s founding Lee family owns a controlling 28 per cent stake in South-east Asia’s second-biggest bank by assets, but its two top C-suite roles are filled by outsiders.

Newly minted group chief executive Tan Teck Long occupies the top management job while Andrew Lee chairs the board – how then does the family exert control over the bank’s operations and strategic directions?

The Lee family is known to maintain a tight grip on its coffers, a recent Bloomberg report said, citing sources. The family has previously shunned investments that threaten its US$38 billion fortune, around half of which is linked to its OCBC holdings.

Examples include the proposed S$2 billion revamp of its OCBC Centre headquarters in 2024 and a sweetened attempt to privatise OCBC’s insurance business Great Eastern. The latter saw OCBC’s former CEO Helen Wong meet long-time Great Eastern shareholders who are part of the Lee family, including Lee Thor Seng and his family, to persuade them to support the privatisation bid.

Citing sources, the report said that in each case, the potential returns were not seen to warrant the costs. Another flashpoint of conflict, it noted, was the bank’s dividend policy.

Notably, the OCBC board’s executive committee is led not by the board chairman or CEO, but by Lee family scion Lee Tih Shih – a grandson of the bank’s late founding father Lee Kong Chian.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

At DBS and UOB, the executive committees are headed by board chairmen Peter Seah and Wong Kan Seng, respectively.

According to OCBC’s website, its exco oversees the management of the business and affairs of the bank and the group; reviews the bank’s policies, principles, strategies, values, objectives and performance targets, including investment and divestment policies; as well as endorses other matters and initiates special reviews and actions “appropriate for the prudent management of the bank”.

Dr Lee Tih Shih, a neuroscientist and professor at Duke-NUS Medical School, is also a director of Lee Foundation and a Lee family-linked entity known as Selat, which collectively own a considerable chunk of the family’s interests in the bank. In addition to Dr Lee Tih Shih, the other exco members are independent directors Andrew Lee and Andrew Khoo.

After the exco, the other important board panels are the nomination, audit and remuneration committees.

The nomination committee comprises independent directors Andrew Khoo (chairman), Andrew Lee, Lian Wee Cheow, Tan Yen Yen, and non-independent director Pramukti Surjaudaja.

It plans for board succession, taking into account diversity, gender equality and sustainability considerations. This includes all nominations for the appointment or reappointment, election or re-election as well as resignation or retirement of directors and members of the exco, remuneration, audit and other board committees.

Crucially, it reviews nominations for the appointment as well as dismissal, resignation or retirement of senior management, including the CEO and chief financial officer.

Tan Teck Long, who has been in his new role as chief for just over a month, needs to position the bank to better compete with rivals such as DBS. Such transformation requires investments that often still need the approval of the Lee family.

He now faces the task of having to balance the interests of the bank, minority shareholders and one of Asia’s wealthiest clans.

The Business Times takes a look at the key players on OCBC’s board and management teams.

Tan Teck Long (group CEO)

Tan Teck Long assumed the role of OCBC’s group CEO on Jan 1, succeeding former chief Helen Wong. Before he stepped into the top job, he was the head of global wholesale banking.

Prior to joining OCBC in 2022, he spent nearly 30 years at DBS, where he was last the chief risk officer.

Dr Lee Tih Shih (exco chair; grandson of OCBC founder Lee Kong Chian)

Dr Lee Tih Shih is one of the few members of the Lee clan who is involved in the bank’s business in an official capacity.

He took on a board role in 2003 and became the only founding Lee family member who is a director at OCBC, after the death of his father Lee Seng Wee in 2015.

Dr Lee Tih Shih reportedly played a role in scouting Tan Teck Long from DBS, with a pitch that included the possibility of landing the top job.

Andrew Lee (chairman)

Andrew Lee assumed the role of non-executive chairman in 2023.

He is not part of the Lee clan, but is said to be a trusted aide of the family who is very hands-on with OCBC affairs, according to the Bloomberg report. Sources say it is essential that Tan Teck Long gets his buy-in when it comes to decision-making.

Andrew Lee is said to have had a difficult relationship with former CEO Helen Wong.

Goh Chin Yee (group chief financial officer)

Goh, a 38-year OCBC veteran, joined the bank as a management trainee in 1988, right after completing her engineering degree at the National University of Singapore, where she graduated with top honours.

Over the years, she rose through the ranks at OCBC and was appointed head of group audit in 2013. Subsequently, she was named group chief financial officer in November 2022.

In November 2024, Goh became responsible for group property management and corporate services, covering corporate real estate and central procurement functions.

She has also worked across many divisions at the bank – spanning strategic management, investment research, fund management, finance, risk management and treasury business management.

Members of the philanthropic Lee clan

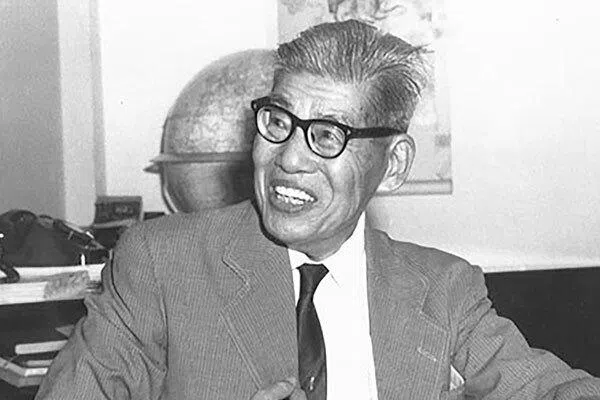

Lee Kong Chian (OCBC founder)

Banking veteran and philanthropist Lee Kong Chian is the founder of OCBC.

Born in Fujian, China, in 1893, he came to Singapore in 1903 at the age of 10. With the financial support of a patron, he underwent formal schooling and excelled academically.

He met prominent entrepreneur Tan Kah Kee and joined his firm, Khiam Aik Company. He subsequently married Tan Kah Kee’s eldest daughter Tan Ai Lay.

During the Great Depression, OCBC was formed from the 1932 merger of three banks – the Chinese Commercial Bank, the Ho Hong Bank and the Oversea-Chinese Bank.

Lee Kong Chian, then the vice-chairman of Chinese Commercial Bank, led the merger.

Lee Seng Gee (eldest son of Lee Kong Chian)

Lee Seng Gee was the eldest son of Lee Kong Chian. He was the chairman of the Lee Foundation from 1965 until his death in 2016.

He was also chairman of the Lee Rubber Group.

Under his leadership, the Lee Foundation disbursed generous donations to support the education and arts sectors, among other charitable endeavours.

Lee Seng Tee (second son of Lee Kong Chian)

Born in 1923, the late philanthropist Lee Seng Tee was the second son of Lee Kong Chian. He also served as chairman of the Lee Foundation.

Lee Seng Tee is a founding member of the Singapore Management University. The Lee Foundation endowed the institution with S$50 million in 2004, to establish its School of Business and a scholars programme.

He died in 2022.

Lee Seng Wee (youngest son of Lee Kong Chian)

Billionaire veteran banker Lee Seng Wee was the youngest of Lee Kong Chian’s three sons.

He served as chairman of OCBC until 2003 and was a board member at the bank for five decades.

He was formerly a director of Great Eastern. He died in 2015.

Lee Thor Seng

The Lee family clan includes low-profile Singapore businessman Lee Thor Seng and his family, who are long-time shareholders of Great Eastern.

Lee Thor Seng and his sons own some 2 per cent of Great Eastern, according to a January 2025 report.

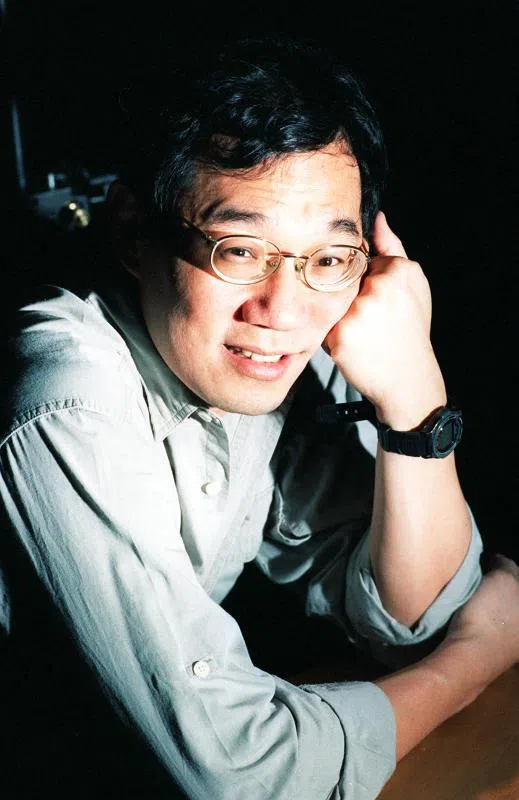

Lee Han Shih

The former BT journalist and son of Lee Seng Gee is now an investor.

He co-founded the Whampoa Group, a multi-family office that has recently expanded into digital asset, crypto investing and private equity.

Whampoa set up the Singapore Gulf Bank, a startup bank in Bahrain that is backed by the kingdom’s sovereign wealth fund, Bahrain Mumtalakat Holding.

As at 2023, he serves as a director on the board of the Lee Foundation.

Lee Chien Shih

He is a director of the Lee Rubber Co and the Lee Foundation.

The son of Lee Seng Wee, Lee Chien Shih was appointed as a board member of Great Eastern in 2005. He stepped down from the board in 2016.

He is a non-executive director of Bukit Sembawang Estates, according to the company website, where he is also a member of the nominating and remuneration committees.

Lee Shih Hua

Lee Shih Hua, son of Lee Seng Tee, has been a director of the Lee Foundation.

He was most recently in the news for purchasing two units at the Seven Palms Sentosa Cove condominium for a total price of S$23.9 million.

He and his brother Lee Shih Kwei also jointly own several properties along Chancery Land in Bukit Timah.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.