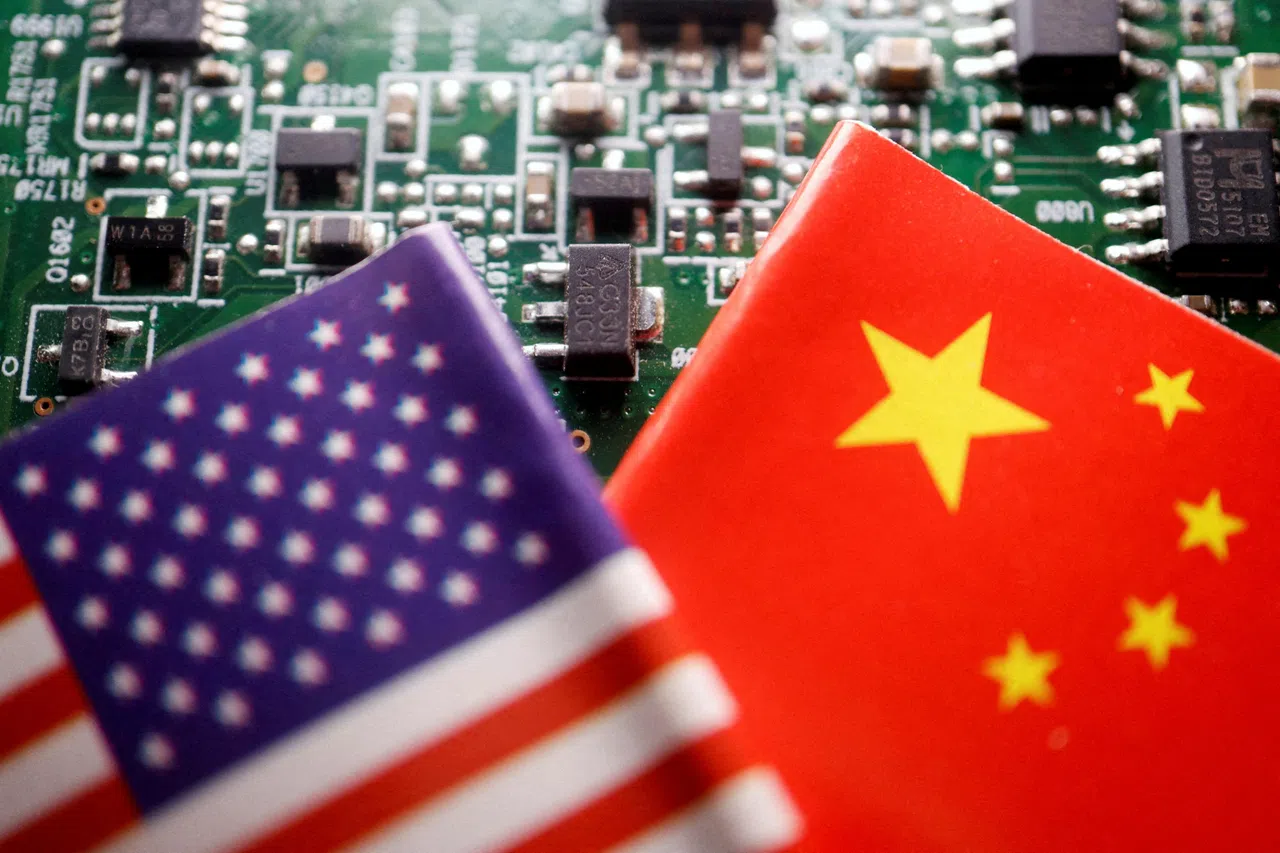

THE Biden administration is considering further restrictions on China’s access to chip technology used for artificial intelligence (AI), targeting new hardware that’s only now making its way into the market, sources familiar with the matter said.

The measures being discussed would limit China’s ability to use a cutting-edge chip architecture known as gate all-around, or GAA, according to the sources, who spoke on condition of anonymity because the deliberations are private. GAA promises to make semiconductors more powerful and is currently being introduced by chipmakers.

It’s unclear when officials will make a final decision, the sources said, emphasising that they are still determining the scope of a potential rule. The US goal is to make it harder for China to assemble the sophisticated computing systems needed to build and operate AI models, they said – and to cordon off still-nascent technology before it’s commercialised.

Companies such as Nvidia, Intel and Advanced Micro Devices (AMD) – along with manufacturing partners Taiwan Semiconductor Manufacturing and Samsung Electronics – are looking to start mass-producing semiconductors with the GAA design within the next year.

Shares of Nvidia dropped as much as 2.5 per cent to US$118.74 in New York on Tuesday (Jun 11) after Bloomberg reported the news. AMD fell 1.9 per cent, while Intel was down less than 1 per cent.

The US has already imposed numerous restrictions on the sale of advanced semiconductors and chipmaking tools to China. Commerce Secretary Gina Raimondo has repeatedly said the US will add to those measures as needed to keep the most advanced AI technology out of Beijing’s hands, over fears that it could give an edge to China’s military.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Still, the Biden administration is running against the clock on issuing additional regulations before the November presidential election and juggling which technologies to prioritise.

A spokesperson for the Commerce Department’s Bureau of Industry and Security (BIS), which oversees export controls, declined to comment. A representative of the National Security Council did not respond to a request for comment.

BIS recently sent a draft GAA rule to what’s known as a technical advisory committee, some of the sources said. The panel is composed of industry experts and offers advice on specific technical parameters – a final step in the regulatory process.

But the rule is not yet finalised, according to the sources, after industry officials criticised the first version as overly broad. It’s unclear whether the ban would restrict China’s ability to develop its own GAA chips or go further and seek to block overseas companies – particularly US chipmakers – from selling their products to Chinese electronics manufacturers.

One source familiar with the matter said the measures wouldn’t go as far as an outright ban on GAA chip exports, but instead focus on the technology needed to make them.

There are also early-stage conversations about limiting exports of high-bandwidth memory chips, some of the sources said. These semiconductors, made by SK Hynix, Micron Technology and others, speed up access to memory, helping bolster AI accelerators. They are used to train AI software – a process that involves bombarding models with information. It’s unclear whether a rule on high-bandwidth memory chips could come together, the sources said, emphasising that the GAA conversation is further along.

Some US allies are pursuing their own GAA technology export control measures as part of a handshake agreement that came together during recent trade talks, according to some of the sources. There are already US restrictions on design software for GAA technology, imposed in 2022 after an agreement the prior year. BLOOMBERG