BITCOIN was perched just below a two-year peak on Tuesday (Mar 5), having jumped to a high above US$68,800 and nearing the all-time high as money keeps rushing into the world’s most traded cryptocurrency.

Bitcoin has gained 50 per cent this year and most of the rise has come in the last few weeks when inflows into US-listed bitcoin funds have surged.

On Tuesday, it was down 1.2 per cent on the day at US$66,709, having risen earlier by as much as 1.97 per cent, trading just shy of November 2021’s all-time peak of US$68,999.99.

“It’s crypto mania 4.0, and I think if we continue to see fairly low bond and rate volatility, it could keep going. There’s definitely something of an irrational behaviour creeping into the market,” said Kyle Rodda, senior markets analyst at Capital.com.

Spot bitcoin exchange-traded funds were approved in the United States earlier this year. Their launch opened the way for new large investors and has re-ignited enthusiasm and momentum reminiscent of the run-up to record levels in 2021.

Net flows into the 10 largest US spot bitcoin funds reached US$2.17 billion in the week to March 1, with more than half of that going into BlackRock’s iShares Bitcoin Trust, according to LSEG data.

“The appetite to gain exposure to Bitcoin is reaching insatiable levels,” said Tony Sycamore, a market analyst at IG.

“While bitcoin is overbought in the short term, the move is far from done, and dips will be well-supported with a move towards US$80,000 not out of the question.”

The rally has come in tandem with records tumbling on stock indexes from Japan’s Nikkei to the S&P 500 and tech-heavy Nasdaq and with volatility gauges in equities and foreign exchange turning lower.

“When we’re at these key psychological levels, these record highs, of course we’re going to see a slowdown of sorts. That is to be fully expected,” Kathleen Brooks, research director at trading platform XTB, said.

Smaller rival ether has hitched a ride on speculation that it too may soon have exchange-traded funds driving inflows, and is up over 50 per cent for the year. It was last up 4.4 per cent on the day at US$3,747.

A regulatory filing on Monday showed the US Securities and Exchange Commission has further delayed its decision on an application by asset manager BlackRock for its spot ethereum exchange-traded fund.

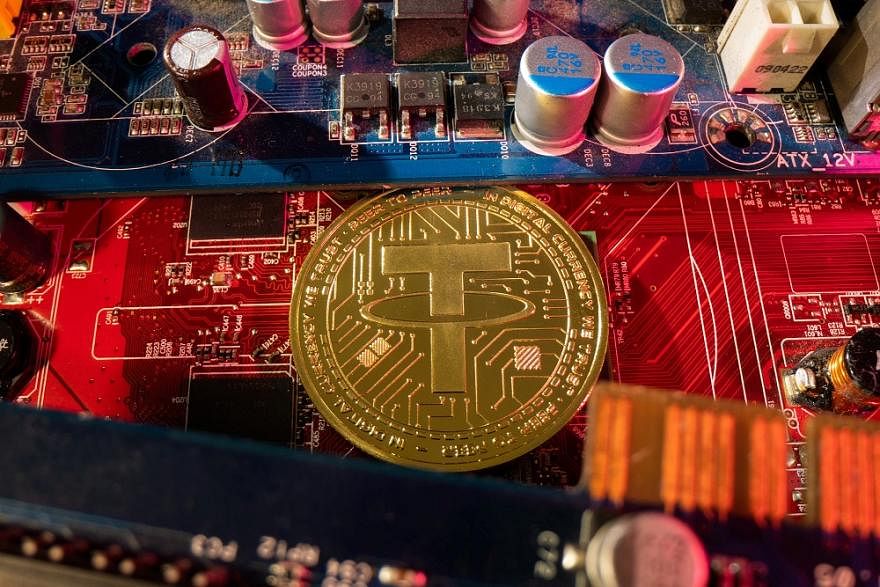

Elsewhere, the number of dollar-pegged stablecoins issued by Tether has crossed US$100 billion, the crypto company said on its website on Monday. Tether issues a stablecoin which is designed to maintain a constant value of US$1. REUTERS