Reuters

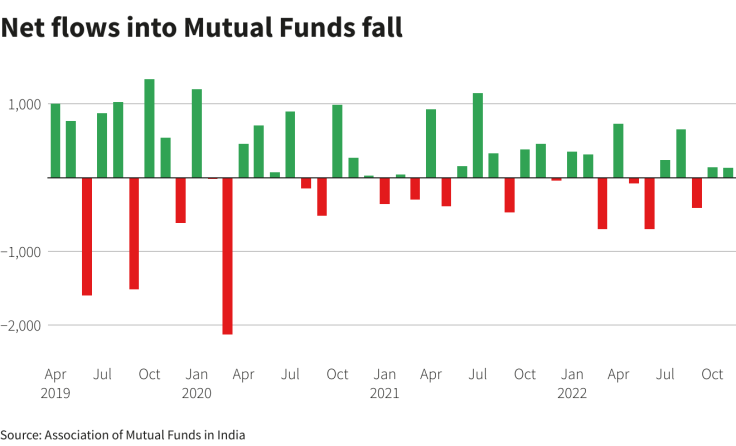

Inflows into Indian equity mutual funds tanked nearly 76% to 22.58 billion Indian rupees ($274.49 million) in November from 93.9 billion rupees in the previous months, even as markets rose to new highs, according to data from the Association of Mutual Funds in India (AMFI).

The fall in inflows into equity and equity linked-schemes comes at a time when shares surged on the back of an uptick in foreign fund flows. The NSE Nifty 50 and S&P BSE Sensex logged monthly gains of 4.14% and 3.87%, respectively, in November.

Net equity inflows slide to 21-month low in November

The decline in net flows is due to mutual funds investors cashing out in a high interest rate regime, AMFI Chief Executive NS Venkatesh said, adding that he “expected retail investors to re-enter the market by March,” when the hike in interest rates would “likely come to an end.”

Systematic investment plans (SIPs)

Contributions to systematic investment plans (SIPs) – where investors make periodic, equal payments into a mutual fund – rose for the fourth consecutive month to a record 133.07 billion rupees in November. The number of SIP accounts rose to 60.5 mln from 59.3 million in October.

SIP contribution rises to record high

Segment-wise trends

All segments saw decline in flows in November. On a relative basis, small-cap funds witnessed most investments at 13.78 billion rupees, while large-cap funds logged worst outflows in 22 months.

Segment-Wise Trends Segment-Wise Trends

AMFI’s Venkatesh said that investors preferred small cap funds to large caps as they saw an opportunity due to the recent correction in the segment which makes the valuations attractive.

Flows into debt funds

Debt funds witnessed mixed trends in November. Liquid funds saw inflows for the second consecutive month.

Liquid funds see inflows for second month in a row

Credit risk funds saw outflows in November after witnessing inflows in October.

Credit risk funds witness outflows in Nov

Net flows in November

The mutual fund industry logged a total net inflow of 132.64 billion rupees, down 5.6% from October. The average assets under management rose 2% to 40.5 trillion rupees from 39.5 trillion rupees in October.

Net flows into Mutual Funds fall to five-month low

($1 = 82.2620 Indian rupees)