Shares of US banks jumped Friday following strong results, but executives cautioned that beneficial industry conditions were moderating and said wars in Ukraine and the Middle East adding uncertainty.

The robust earnings at JPMorgan Chase, Citi and Wells Fargo reflect a continued boost from higher interest rates, as well as the lift from a persistently healthy US employment market that has limited loan delinquencies.

Executives said household balance sheets had eroded somewhat in recent months, but were still above the pre-pandemic level.

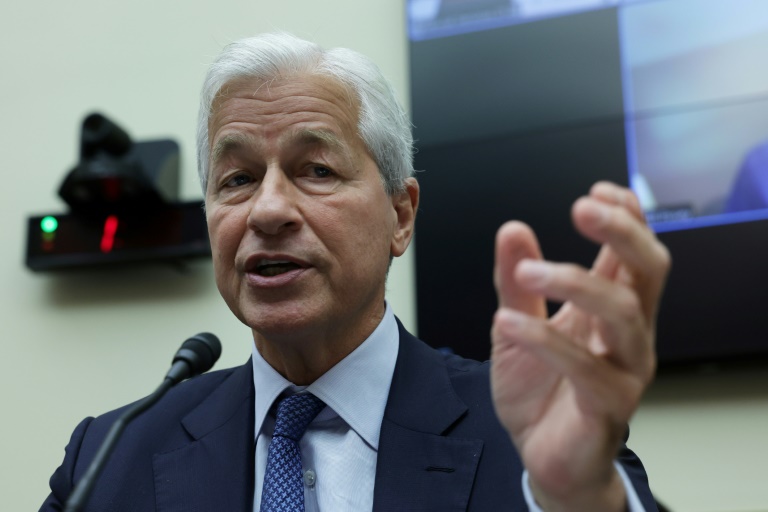

“US consumers and businesses generally remain healthy, although, consumers are spending down their excess cash buffers,” said JPMorgan Chase Chief Executive Jamie Dimon.

Dimon reiterated that the economy faces significant headwinds.

“Persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here,” said Dimon in the earnings press release.

“The war in Ukraine compounded by last week’s attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades.”

Later, on a call with Wall Street analysts, Dimon said investors should not misread the relatively health of financial markets.

“My caution is that we are facing so many uncertainties out there,” he said.

JPMorgan, the biggest US bank in terms of assets, reported third-quarter profits of $13.2 billion, up 35 percent from the year-ago period.

Revenues rose 22 percent to $39.9 billion.

The biggest factor in the profit jump was the much increased earnings in net interest income (NII), which measures the gap between what the bank makes in interest in loans to clients compared with interest payments to customers.

JPMorgan again increased its full-year NII forecast, which essentially shows that the bank has been able to benefit from consumers who have kept money in accounts receiving lower interest than are available elsewhere in the market.

Bank executives have said in recent months that they expect this dynamic to “normalize,” reiterating that view on Friday.

“We don’t know exactly when, but we know it will” normalize, Chief Financial Officer Jeremy Barnum said on a conference call with reporters. “We’re going to respond to competition.”

A second factor behind the strong results has been the continually healthy state of consumer balance sheets, which has limited the number of defaults.

Throughout the Covid-19 period and in the immediate aftermath, consumers have largely successfully managed credit card payments, although delinquencies have risen in recent quarters.

JPMorgan actually had lower credit costs compared with the year-ago period, a dynamic not seen at the other two banks that reported Friday.

Citi reported profits of $3.5 billion, up two percent from the year-ago period, while revenues rose nine percent to $20.1 billion.

Citi’s results were also boosted by higher NII, but that was offset somewhat by higher credit costs.

Chief Financial Officer Mark Mason said consumers remain “quite resilient,” but credit card payment rates have started to decline “a bit,” especially for customers with lower credit scores.

The bank still has “a base case” of a “mild” in the first half of 2024, although “the US keeps surprising us with this resilience,” Mason said.

Mason also said “there’s a lot of uncertainty that ultimately gets factored into how things play out,” pointing to Russia and Israel.

At Wells Fargo, profits jumped 61 percent to $5.8 billion on 6.6 percent rise in revenues to $20.9 billion.

Results were boosted by higher NII, but the bank also pointed to some erosion in household financial health.

“While the economy has continued to be resilient, we are seeing the impact of the slowing economy with loan balances declining and charge-offs continuing to deteriorate modestly,” said Wells Fargo Chief Financial Officer Charlie Scharf.

Shares of JPMorgan rose 3.5 percent shortly after midday, while Citi climbed 2.6 percent and Wells Fargo advanced 3.4 percent.