Real estate developers building the athletes’ village for this year’s Paris Olympics are struggling to find buyers for their apartments once the Games have finished due to a downturn in the French property market.

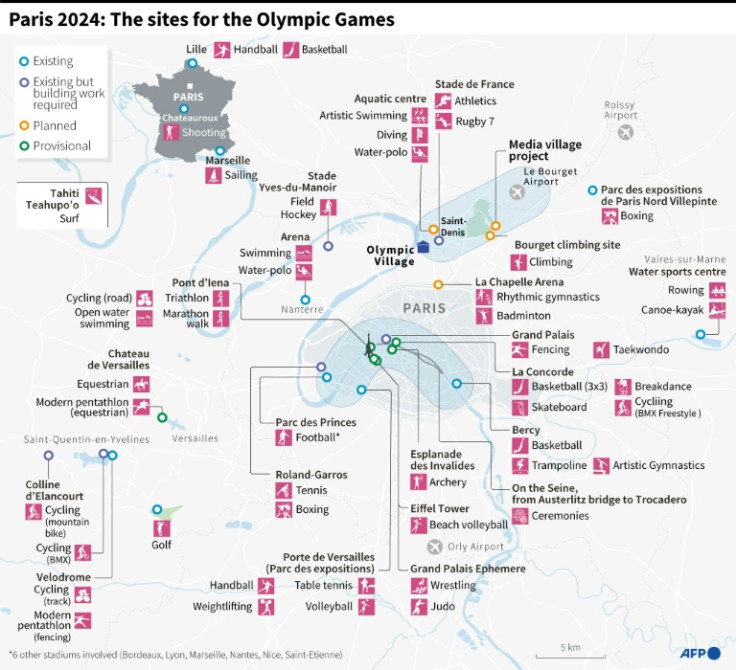

The vast complex in the deprived Saint-Ouen suburb of northern Paris has been one of the biggest construction sites in Europe over the last four years and is now nearing completion ahead of the start of the Games on July 26.

Many of France’s biggest building groups have built residential towers there, which will host 10,500 athletes during the Olympics before being converted into private homes, social housing and student accommodation.

Of the 88 apartments put up for private sale by the Icade group in July “around ten” have sold, according to an executive at the company, with prices now being reduced by around nine percent to 6,900 euros/m2.

That compares favourably at least with average Paris prices of around 10,000 euros/m2.

“Market conditions are a bit tricky at the moment with the rise in interest rates,” Thibault Angles, head of the programme at Icade, told the BFM channel last week.

Competitor Vinci says on its website that it has sold under half of its apartments that are currently up for sale, with around 100 still on the market.

Thomas Lefebvre, an expert at online real estate websites SeLoger and Meilleurs Agents, said that sales of new-build homes had fallen by about 30 percent over the last year in France.

“The market has turned very quickly, quite abruptly,” he told AFP. “We’ve gone from interest rates of around 1.0 percent in January 2022 to 4.0 percent today. The number of buyers has fallen considerably.”.

The lacklustre sales at the Olympic village reflect this wider downturn in the Paris property market where prices fell by 2.4 percent last year, according to the country’s biggest real estate agency, Century 21.

It expects prices nation-wide to fall by 5-10 percent this year.

“Some developers decided to test the market for their (Olympics) apartments well in advance, others will probably wait,” a source at a company working on Olympics infrastructure told AFP on condition of anonymity.

“Obviously they were expecting different market conditions a few years ago.”

Central banks across the West have hiked their rates over the last 18 months to bring down inflation sparked by the war in Ukraine, leading banks to rein in their lending.

The lack of buyers at the athletes’ village will have no impact on the Games themselves or the budget, but the 3,000-apartment complex is a key part of the intended legacy of the event.

Most of the new infrastucture for the Games and the village were deliberately placed in the Seine-Saint-Denis area northeast of Paris with a view to regenerating the most deprived area of mainland France.

In a falling market, part of the challenge for developers is drawing middle-class families to an area long associated in the public mind with run-down housing estates and high crime.

“They haven’t put them on sale too early, they put them on sale with prices that were too high,” Selim Mouhoubi, who runs the local Stephane Plaza real estate agency in Saint-Ouen, told AFP.

“It’s always a question of price.”

He thinks prices will have to fall another 5-10 percent.

Developers insist there is no need to panic and they have time on their side.

After the end of the Olympics and Paralympics on September 8, the apartments will need to be modified and fitted out under work that is expected to take another year of work.

“The only problem at the moment is the context. It’s not a bad move to invest in this area,” added Mouhoubi, who said the investments in new transport and schools made it one of the most promising neighbourhoods in the whole Paris area.

AFP

AFP